What IT executives are saying about vendor consolidation

As the tech economy has adjusted to the current economic environment, there has been a great deal of debate in both the vendor and investor communities about vendor consolidation.

As the tech economy has adjusted to the current economic environment, there has been a great deal of debate in both the vendor and investor communities about vendor consolidation. While there is little doubt that companies have been cutting back on expenses generally in response to economic uncertainty, startups in particular have been feeling the pain of contracting budgets and reluctant investors.

Thanks to the team at Foundry, I was able to gain input from those whose opinions matter most – the senior IT executives at mid-sized to large companies who are placing the purchase orders and determining which vendors to leverage – and which to cut back. We recently ran a poll on the CIO Tech Talk community to ask questions and gauge input on the topic of vendor consolidation from the buyer’s perspective: how real it is, how widespread, and whether this is a permanent shift or just a short-term blip.

Our poll received excellent feedback – in addition to receiving a significant base of survey respondents, a number of community members provided additional commentary. While I expected this exercise to confirm that consolidation is real, I was pleasantly surprised with the degree to which the CIO Tech Talk Community confirmed it – and how they are taking steps to realign their procurement and vendor management strategies.

Vendor consolidation is very real

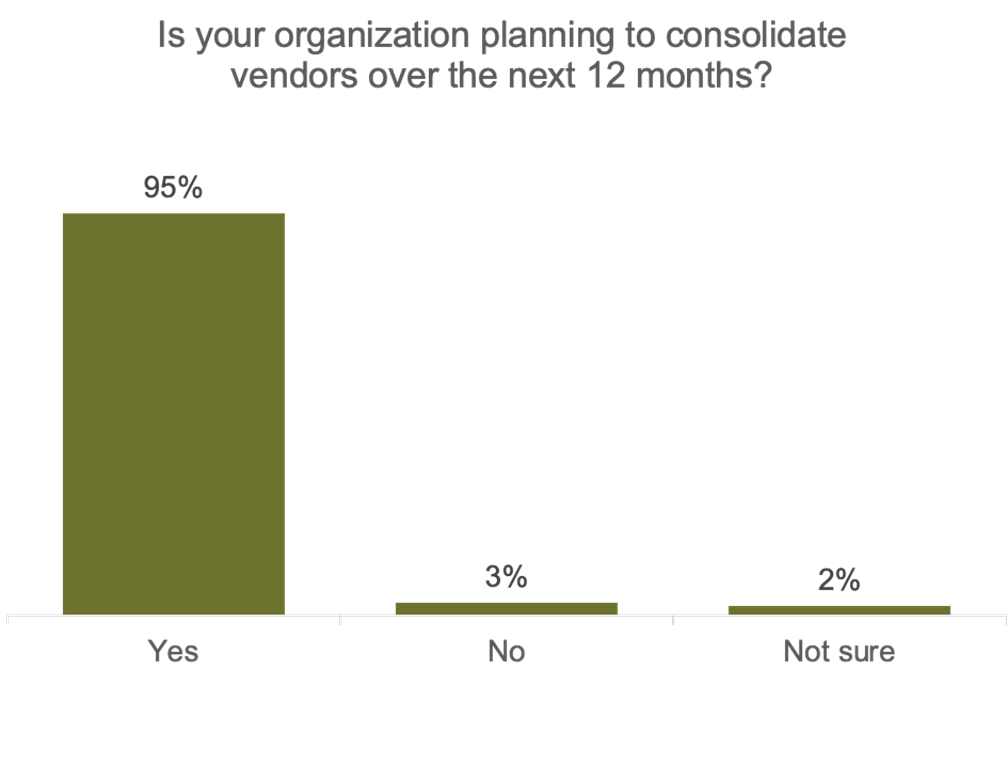

We got right to the point with the first question – “Is your organization planning to consolidate vendors in the next 12 months” – and the answer we got back from the community was stunningly clear and unambiguous – 95% of respondents confirmed that, yes, they are planning to consolidate.

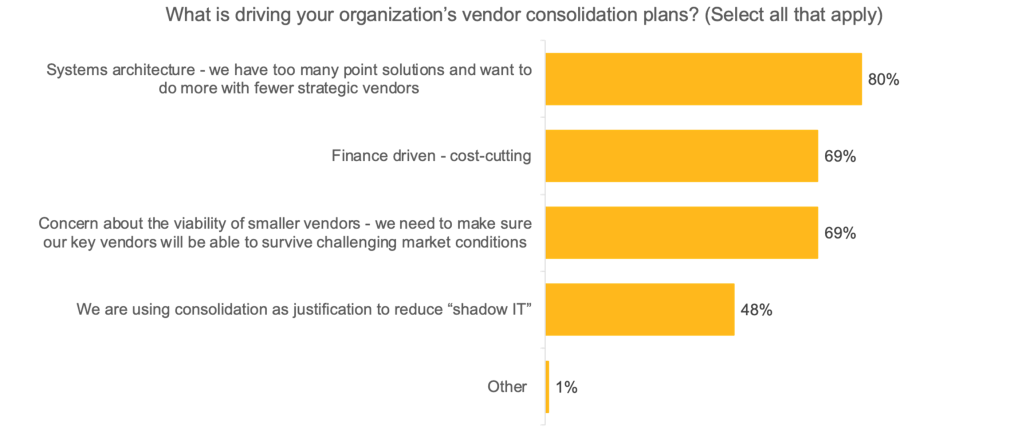

When we asked what’s driving that consolidation, finance-driven reasons were close to – but not at – the top. An even greater reason given was the desire to consolidate systems architecture and reduce the number of “point solutions” – which 80% of respondents cited as a consolidation driver – while 69% of respondents cited finance driven cost-cutting.

As buyers consolidate, pressure on vendors increases

Clearly there is pressure to consolidate – both internally and externally driven. When we asked about the intensity of that pressure, 83% cited a moderate to high degree of pressure.