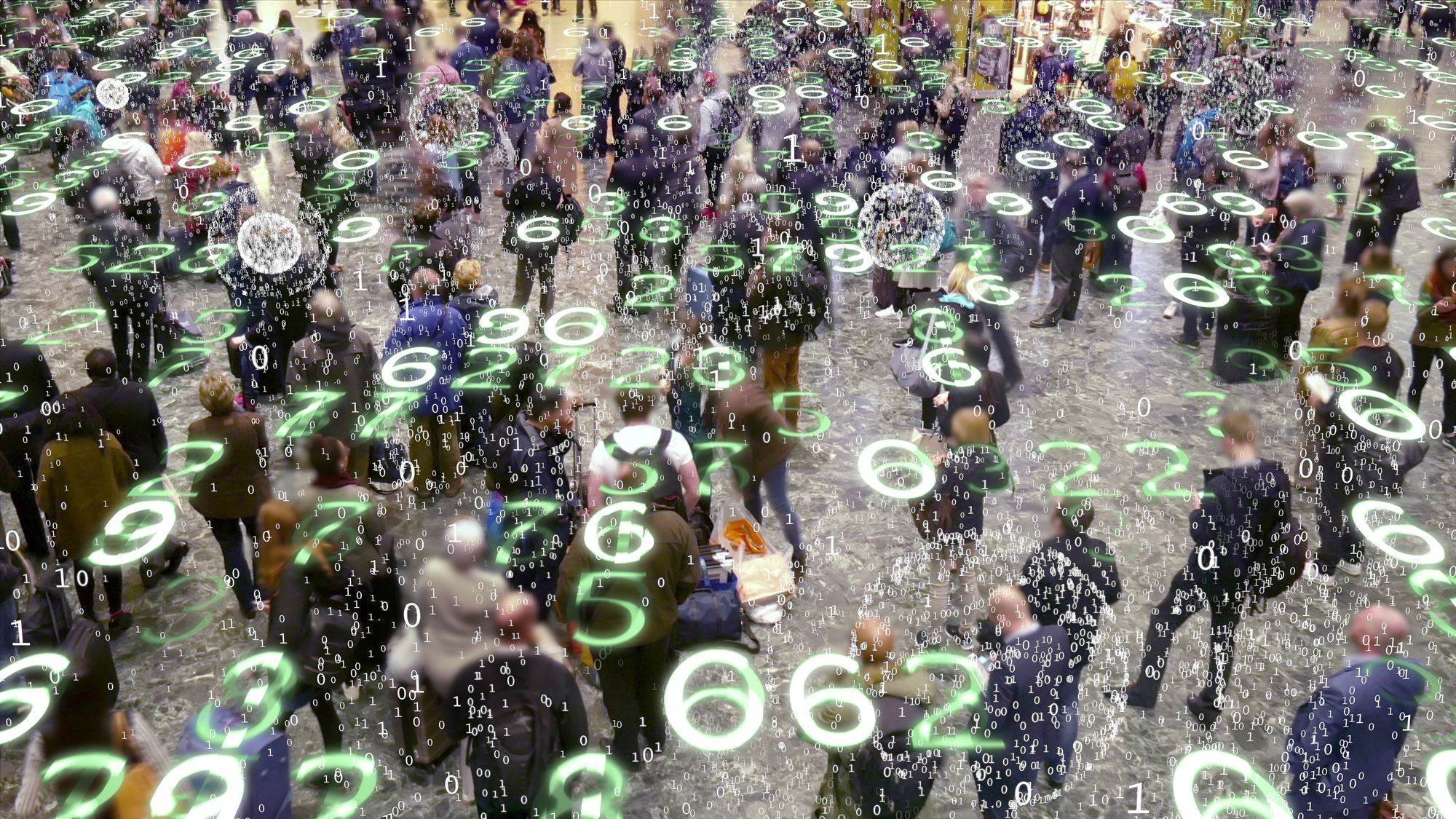

Endeavour Group has called on state and territory governments to coordinate a national approach to using facial recognition technology to combat problem gambling and money laundering at gaming venues.

The operator of roughly 300 hotels and pubs revealed in a financial filing [pdf] today that it had “now written to state governments to seek a more coordinated and collaborative approach” on facial recognition and other digitally-oriented gambling controls.

The different jurisdictions would be able to more effectively use facial recognition technology to minimise harm and prevent financial crime if they shared knowledge and worked from a common national framework, the company said.

“We believe that if someone has chosen to self-exclude, we should use technology available to assist them to do so,” Endeavour Group CEO and managing director Steve Donohue said.

“Facial recognition technology is already in place in South Australia, and is slated for introduction in Queensland and NSW.”

South Australia has made it mandatory for venues operating at least 30 poker machines to use facial recognition technology to enforce self-exclusion schemes.

The NSW government has also said it will mandate the technology to both enforce self-exclusion and identify criminals and suspects.

A spokesperson for NSW minister for gaming and racing David Harris told iTnews that the NSW government “has committed to a range of further gaming reforms including the use of facial recognition technology in clubs and pubs by July 1 2024.”

Safeguarding biometrics data

While being targeted to limit problem gambling, reform advocates have said that there are inadequate regulations to prevent the industry from using biometric data gathered through facial recognition technology to induce gambling and make their customer service more targeted.

“You see in the US that facial recognition technology has been used to identify facial expressions and respond to them in ways that incentivise gambling,” the Alliance For Gambling Reform’s CEO Carrol Bennett said.

“There’s no evidence the gaming industry is doing this in Australia, but there’s also no evidence they’re not – because who’s asking?

“I don’t think the state gambling regulators have had their eyes on the ball when it comes to monitoring these matters like how data or facial recognition technology is used.”

In NSW – where more than 100 pubs and clubs have already voluntarily deployed facial recognition technology – regulating the use of the biometric data is the Office of the Australian Information Commissioner’s responsibility, a spokesperson for Liquor & Gaming NSW told iTnews.

The spokesperson said, “The NSW government has committed to requiring the use of facial recognition technology in hotels and clubs.

“This, along with other gaming-related reforms, will be assessed by [an] independent panel established to oversee the government’s cashless gaming trials.

“It will include consideration of robust privacy and data security protocols, as well as mechanisms to ensure this technology cannot be used to facilitate distribution of marketing or promotional material.”

A spokesperson for the Victorian Gambling and Casino Control Commission told iTnews that it doesn’t monitor “the way gambling venues use data from facial recognition technology.”

“This is not within our regulatory remit,” the spokesperson said.

“Victorian gambling legislation neither mandates nor prohibits the use of facial recognition technology in gambling venues.”

Alternatives available

Consumer rights and privacy group CHOICE told iTnews that it was not clear why gaming venues need to use facial recognition technology to enforce the self-exclusion scheme when there are alternative ways to identify people who have signed up to the scheme trying to use poker machines.

Mandatory, pre-commitment cashless cards are being trialled and introduced across states and are linked to users’ identity; CHOICE consumer data advocate Kate Bower said that this made the cards functionally the same as facial recognition technology.

“An investigation by the Tasmanian government last year into gambling harm minimisation showed that when strategies such as cashless gaming cards are in place, the use of facial recognition for harm reduction becomes redundant,” Bower told iTnews.

“When introducing any new technology, risks to privacy and human rights must be considered along with benefits, to ensure that it is the most appropriate technology for the intended purpose.”