In

last

year’s

edition

of

the

Security

Navigator

we

noted

that

the

Manufacturing

Industry

appeared

to

be

totally

over-represented

in

our

dataset

of

Cyber

Extortion

victims.

Neither

the

number

of

businesses

nor

their

average

revenue

particularly

stood

out

to

explain

this.

Manufacturing

was

also

the

most

represented

Industry

in

our

CyberSOC

dataset

–

contributing

more

Incidents

than

any

other

sector.

We

found

this

trend

confirmed

in

2023

–

so

much

in

fact

that

we

decided

to

take

a

closer

look.

So

let’s

examine

some

possible

explanations.

And

debunk

them.

Hunting

for

possible

explanations

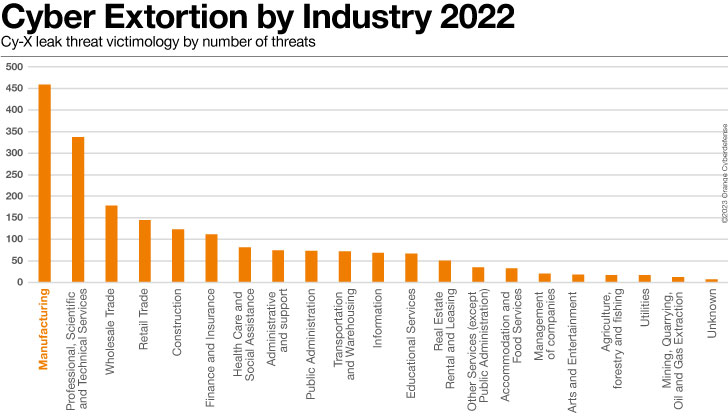

Manufacturing

is

still

the

most

impacted

industry

in

our

Cyber

Extortion

dataset

in

2023,

as

tracked

by

monitoring

double-extortion

leak

sites.

Indeed,

this

sector

now

represents

more

than

20%

of

all

victims

since

we

started

observing

the

leak

sites

in

the

beginning

of

2020.

Approximately

28%

of

all

our

clients

are

from

Manufacturing,

contributing

with

an

overall

share

of

31%

of

all

potential

incidents

we

investigated.

We

note

that

58%

of

the

Incidents

this

industry

deals

with

are

internally

caused,

32%

were

externally

caused,

1%

was

classified

as

“Partner”

or

3rd

parties.

When

external

threat

actors

had

caused

the

security

incident,

we

observed

the

top

3

threat

actions

were

Web

Attacks,

Port

Scanning

and

Phishing.

On

the

other

hand,

Manufacturing

has

the

lowest

apparent

number

of

confirmed

security

vulnerabilities

per

IT

Asset

in

our

Vulnerability

scanning

dataset.

Our

pentesting

teams

on

the

other

hand

report

4.81

CVSS

findings

per

day,

which

is

quite

a

bit

above

the

average

of

3.61

across

all

other

industries.

Several

questions

present

themselves,

which

we

will

attempt

to

examine

here:

-

What

part

does

Operation

Technology

play? -

Are

businesses

in

Manufacturing

more

vulnerable? -

Is

the

Manufacturing

sector

being

deliberately

targeted

more? -

Do

our

Manufacturing

clients

experience

more

incidents?

What

part

does

OT

play?

A

tempting

assumption

to

make

is

that

businesses

in

the

Manufacturing

sector

are

compromised

more

often

via

notoriously

insecure

Operational

Technology

(OT)

or

Internet

of

Things

(IoT)

systems.

Plants

and

factories

can

often

not

afford

to

be

disrupted

or

shut

down

and

that

Manufacturing

is

therefore

a

soft

target

for

extortionists.

It

sure

sounds

plausible.

The

catch

is:

we

don’t

see

these

theories

supported

in

our

data.

The

attack

against

US

Energy

giant

Colonial

Pipeline

was

probably

the

most

notable

recent

example

of

a

successful

attack

against

an

industrial

facility.

Discover

the

latest

in

cybersecurity

with

comprehensive

“Security

Navigator

2023”

report.

This

research-driven

report

is

based

on

100%

first-hand

information

from

17

global

SOCs

and

13

CyberSOCs

of

Orange

Cyberdefense,

the

CERT,

Epidemiology

Labs

and

World

Watch

and

provides

a

wealth

of

valuable

information

and

insights

into

the

current

and

future

threat

landscape.

In

July

this

year

US

intelligence

agencies

even

warned

of

a

hacking

toolset

dubbed

‘Pipedream’

that

is

designed

target

specific

Industrial

Control

Systems.

But

it

is

not

clear

to

us

if

or

when

these

tools

have

ever

been

encountered

in

the

wild.

Apart

from

the

infamous

Stuxnet

attack

from

2010,

one

struggles

to

recall

a

single

cyber

security

incident

where

the

entry

point

was

an

OT

system.

At

Colonial

Pipeline

the

backend

‘conventional’

administrative

systems

were

compromised

first.

Looking

more

closely,

this

is

the

case

for

almost

all

reported

incidents

at

industrial

facilities.

Are

businesses

in

the

Manufacturing

sector

more

vulnerable

to

attacks?

To

answer

this

questions

we

examined

a

set

of

3

million

vulnerability

scan

findings,

and

a

sample

of

1,400

Ethical

Hacking

reports.

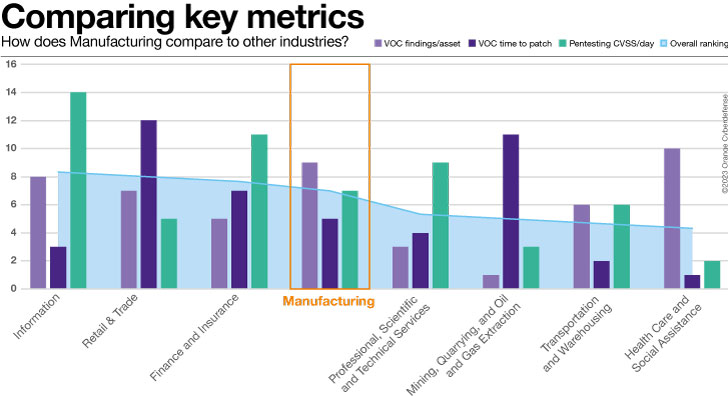

We

derived

three

metrics

that

facilitate

somewhat

normalized

comparisons

across

the

industries

in

our

client

base:

VOC

scanning

findings

per

asset,

time

to

patch,

Pentest

findings

per

day

of

testing.

If

we

rank

industries

for

their

performance

on

each

of

those

metrics

and

sort

from

worst

to

best,

then

our

clients

in

the

Manufacturing

sector

arrives

in

5th

place

out

of

12

comparable

industries.

The

chart

below

shows

the

overall

*ranking*

of

our

Manufacturing

clients

out

of

comparable

industries.

VOC

unique

findings/asset

On

this

metric

there

were

seven

other

industries

that

performed

better

than

Manufacturing.

While

we

have

a

comparatively

high

number

of

assets

from

Manufacturing

clients

in

our

scanning

dataset,

we

report

far

fewer

Findings

per

Asset

than

the

average

across

all

industries.

Almost

10

times

fewer,

in

fact.

Time

to

patch

On

this

metric

6

other

industries

ranked

better

than

Manufacturing.

The

average

age

of

all

findings

for

this

industry

is

419

days,

which

is

a

concerning

number

and

worse

than

recorded

for

eight

other

industries

in

this

dataset.

Pentesting

findings

We

observe

that

the

average

CVSS

Per

Day

was

4.81,

compared

to

3.61

on

average

for

clients

in

all

other

sectors

in

the

dataset

–

33%

higher.

Is

the

Manufacturing

sector

being

targeted

more

by

extortionists?

We

use

the

North

American

Industry

Classification

System

–

NAICS

–

classification

system

when

categorizing

our

clients.

A

consideration

of

double-extortion

victim

counts

per

industry

reveals

a

very

interesting

pattern:

Of

the

10

industries

with

the

most

recorded

victims

in

the

dataset,

7

are

also

counted

amongst

the

biggest

industries

by

entity

count.

Manufacturing

however,

is

a

clear

trend-breaker.

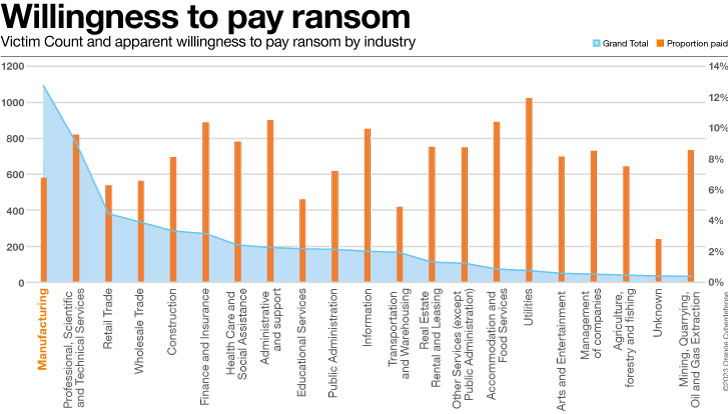

Another

factor

raises

questions:

if

businesses

in

the

Manufacturing

sector

were

more

willing

to

pay

ransom

that

would

make

them

more

attractive

as

victims.

But

then

we

would

expect

to

see

such

businesses

featuring

on

the

‘name

and

shame’

leak

site

less

often,

not

more.

Do

our

Manufacturing

clients

experience

more

incidents?

The

Manufacturing

industry

once

again

generated

the

highest

number

of

Incidents

as

a

percentage

of

the

total

in

our

CyberSOC

dataset.

31%

of

all

Incidents

are

generated

for

the

28%

of

our

clients

that

are

from

this

sector.

The

Incident

data

lacks

context,

however.

To

establish

a

baseline

for

comparison,

we

assign

customers

a

‘Coverage

Score’

between

0

and

5

in

8

different

‘domains’

of

Threat

Detection,

accounting

for

a

maximum

total

detection

score

of

40.

We

use

the

coverage

score

to

normalize

the

incident

count.

Put

simply,

the

lower

a

client’s

assessed

coverage

score

is,

the

more

this

adjustment

will

‘boost’

the

number

of

Incidents

in

this

comparison.

The

logic

is

that

a

low

amount

of

coverage

will

just

not

show

us

a

lot

of

incidents,

though

they

very

likely

occurr.

If

we

adjust

the

True

Positive

and

False

Positive

Incidents

as

described

above,

we

still

see

more

than

seven

times

as

many

Incidents

per

clients

from

Manufacturing

than

the

average

for

all

industries.

In

a

similar

comparison,

limited

only

to

Perimeter

Security,

and

only

Medium

Sized

business,

Manufacturing

ranks

1st

with

the

most

Incidents

per

Customer

out

of

7

comparable

Industries.

Conclusion

We

ruled

out

a

massive

impact

of

OT

security

vulnerabilities,

and

therefore

focus

on

regular

IT

systems.

Our

scanning

teams

assessed

a

large

number

of

targets

but

reported

relatively

few

vulnerabilities

per

asset.

Overall,

we

rank

the

Manufacturing

sector

as

5th

or

6th

weakest

of

all

industries

from

a

vulnerability

point

of

view.

The

question

of

why

we

consistently

record

such

a

high

proportion

of

victims

from

the

Manufacturing

industry

is

not

readily

answered

with

the

data

we

have.

We

believe

that

in

the

end

it

still

comes

down

to

the

level

of

vulnerability,

best

reflected

in

our

Penetration

Testing,

and

Findings

Age

data.

All

of

our

data

points

to

the

fact

that

attackers

are

mostly

opportunistic.

Rather

than

deliberately

singling

industries

out,

they

simply

compromise

businesses

that

are

vulnerable.

The

customers

represented

in

our

datasets

have

engaged

with

us

for

Vulnerability

Assessment

or

Managed

Detection,

and

therefore

represent

relatively

‘mature’

examples

of

that

industry.

We

can

deduce

that

average

businesses

in

this

sector

would

benchmark

worse

in

terms

of

vulnerabilities.

Whether

the

high

number

of

victims

we

observe

on

attacker

leak-sites

is

a

direct

reflection

of

the

high

number

of

overall

victims

in

this

sector,

or

the

skewed

reflection

of

an

industry

that

refuses

to

concede

to

initial

ransom

demands,

is

not

entirely

clear.

What

does

appear

likely,

however,

is

that

vulnerability

is

the

primary

factor

that

determines

which

businesses

get

compromised

and

extorted

–

in

this

sector

as

much

as

any

other.

This

is

just

an

excerpt

of

the

analysis.

More

details

on

how

different

Industries

performed

in

comparison

to

others,

as

well

as

more

CyberSOC,

Pentesting

and

VOC

data

(along

with

plenty

of

other

interesting

research

topics)

can

be

found

in

the

Security

Navigator.

It’s

free

of

charge,

so

have

a

look.

It’s

worth

it!

Note:

This

article

has

been

written

and

contributed

by

Charl

van

der

Walt,

Head

of

Security

Research

at

Orange

Cyberdefense.

this

article

interesting?

Follow

us

on

and

to

read

more

exclusive

content

we

post.