Taxing times: Top IRS scams to look out for in 2026

It’s time to file your tax return. And cybercriminals are lurking to make an already stressful period even more edgy.

10 Feb 2026

•

,

5 min. read

To misquote Benjamin Franklin, nothing is certain in this world except for death, taxes and scammers. Unfortunately, with tax filing season now in full swing, the fraudsters are also out in force, doing their best to cash in. The risk of unwittingly sharing personal and financial information, enabling third parties to hijack your tax refunds, or even being tricked into committing fraud yourself, has grown immeasurably over recent years.

To stay on the right side of the law, and keep the scammers at bay, read on.

How to spot the scams

Tax and IRS scams in general contain many of the same warning signs you should associate with other digital fraud types. Scammers may impersonate the IRS or tax preparers via phone/email/text, using official logos or spoofing caller ID/sender domains. They may even demand money or fines. Or they could trick you into filing fraudulent returns. Whatever the pretext, chances are that the fraudsters could also leverage AI to supercharge their schemes.

Just remember the following warning signs:

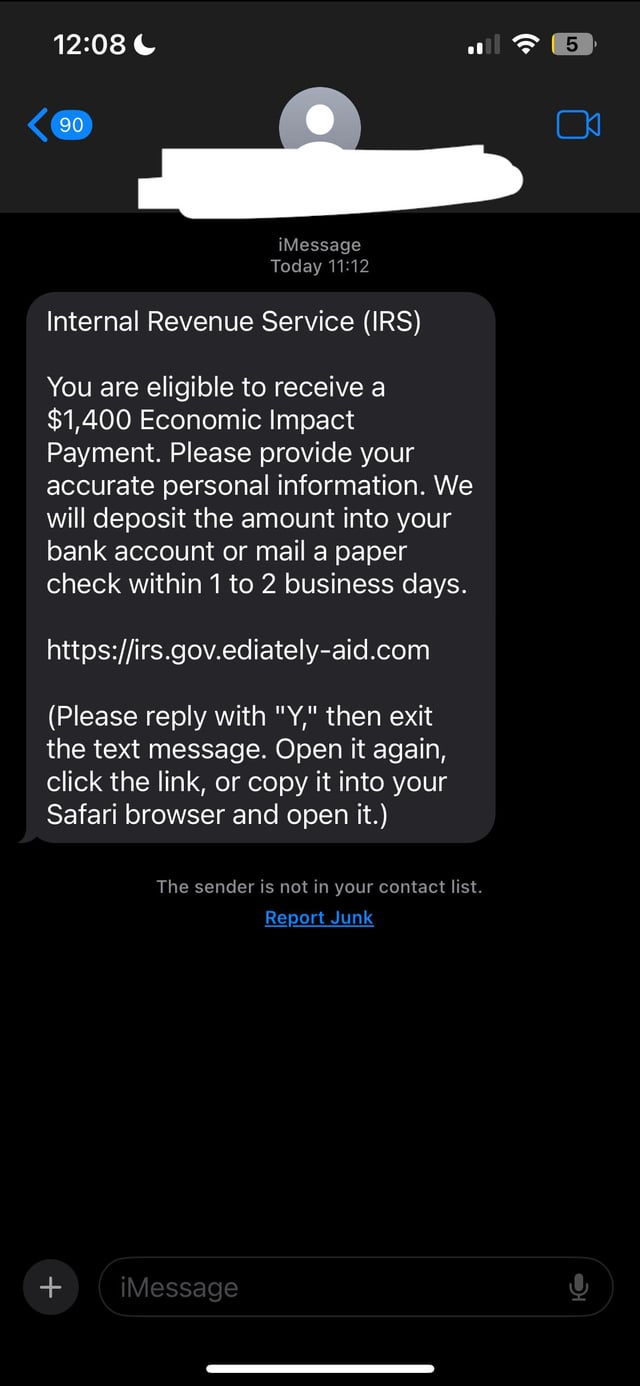

- An unsolicited email/text/call from the IRS. The tax-collection agency will always make contact initially via an official letter through the mail, not a text message.

- The IRS demands immediate payment to avoid arrest or further penalties. The IRS will always provide taxpayers time to appeal or query outstanding sums.

- Scammers will ask for payment by unusual means, such as gift card or cryptocurrency, which the IRS doesn’t accept.

- You are ordered to share personal and/or financial information like credit card numbers and banking logins. The IRS will never call, text or email asking for such details.

- With the rise of AI-aided scams, your eyes and ears can no longer be trusted as primary authentication mechanisms. Remember that the IRS will never initiate unsolicited contact via email, text, or social media to ask for your personal or financial information.

The most common IRS scams

With the above in mind, look out for the following most common IRS and tax return scams:

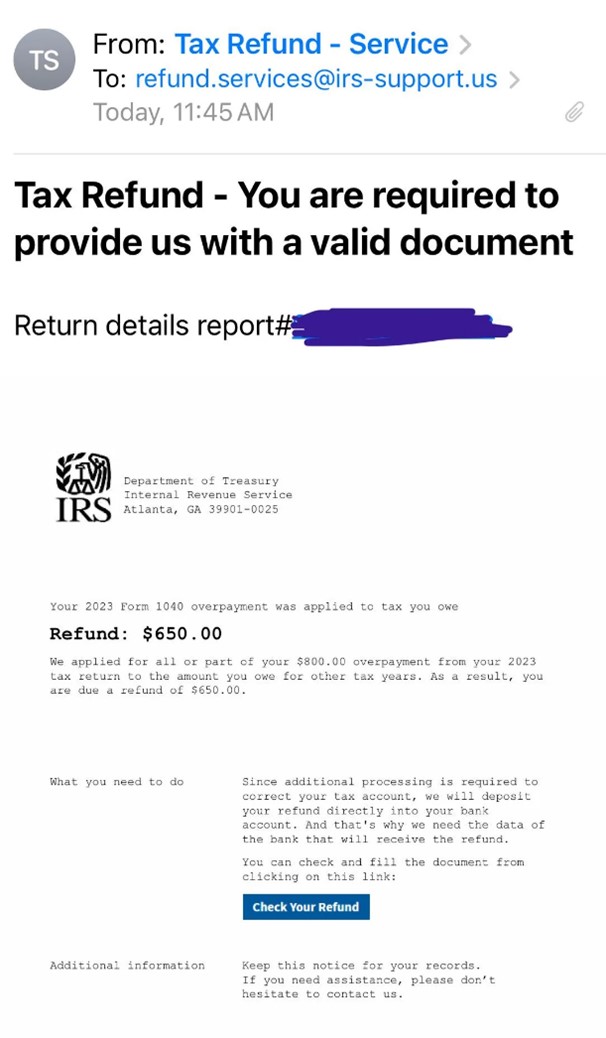

Phishing/smishing/vishing

Emails, texts and even phone calls purporting to come from tax authorities (e.g., IRS, state tax agencies and tax software companies). The end goal is to trick you into handing over cash, sensitive personal/financial information, or installing malware on your device. The scammers may use a pretext such as an unexpected tax refund. Or they could go down a different route and claim your account has been suspended and/or you will face serious repercussions unless you atone for ‘unpaid taxes’.

Whatever the lure, they’ll usually ask you to provide more information, send them money, and/or click on a malicious link.

Tax refunds

The IRS tax refund system offers several opportunities for scammers to make easy money. All they need is your personal information (including Social Security details, name and date of birth) to file, and deposit the refund in a bank account under their control. The first you might find out is when your legitimate filing is rejected because a return has already been sent in under your name.

Alternatively, scammers impersonating the IRS might send you an unsolicited email/text claiming you are owed a big rebate or refund. They’ll ask you to visit a phishing website mirroring the IRS one to ‘verify your account’ details.

W-2 form scams

A social media influencer advertises a ‘secret trick’ which you can use to game the tax system and get a large refund. All you have to do is create a fake W-2 form, report inflated earnings and large tax bills, and pay them a fee. By doing this, you are committing fraud and could face major financial penalties from the IRS, or even a criminal investigation. Even worse, as well as paying the scammer, you have also shared your personal and tax details, which they can use in follow-on fraud.

Self-employment tax credit

Also circulating on social media are claims made by scammers about a non-existent “Self-Employment Tax Credit.” According to the IRS, they claim self-employed people and gig workers can get big COVID-19 payments by filling in the right forms. Once again, they do so to get their hands on your cash and personal information.

Dishonest tax preparers

It’s also wise to be on the lookout for unscrupulous “tax professionals” who may substitute their bank account information for your own in order to divert tax refunds. They might prepare a tax return but then charge a fee based on the size of the refund. Be suspicious of any that refuse to sign or include their IRS Preparer Tax Identification Number (PTIN).

What happens next?

If you suspect an IRS scam, the best thing to do is to halt all communications. That means hanging up the phone, and deleting any phishing email and/or text. If you’re talking to someone and aren’t sure if they’re the real deal or not, ask for their name and call back number and check the details online. Scam emails can be sent to phishing@irs.gov before deletion, while you can submit an official fraud report to the IRS here.

Staying safe from IRS scams

To avoid becoming another victim of scams like the ones listed above, stay on the lookout for the warning signs we’ve included for you. Unsolicited contact, promises of large refunds, and threats of fines or arrest should be immediate red flags. Report the attempted scam and hang up or delete. It also pays to be cautious about any “tax tricks” or tips you might see on social media, especially if they involve paying fees to a third party or handing over any of your personal/financial information.

For added security and peace of mind, switch on multifactor authentication (MFA) for any account used to access tax and financial information. This should keep them safe even if threat actors get hold of your logins. An IRS Identity Protection PIN (IP PIN) may also be a good idea, to ensure no third party can file a return using your Social Security number (SSN) or individual taxpayer identification number (ITIN).

Finally, consider filing your returns early – as soon as you receive your W-2 form. That way, scammers won’t be able to beat you to a possible refund. None of these are guaranteed to stop the scammers. But combined, they will send a clear message.