Social engineering. It’s a con game. And a con game by any other name stings just as badly.

Like any form of con, social engineering dupes their victims by playing on their emotions. Fear, excitement, and surprise. And they prey on human nature as well. The desire to help others, recognizing authority, and even the dream of hitting it big in the lottery. All of this comes into play in social engineering.

By design, the scammers who employ social engineering do so in an attempt to bilk people out of their personal information, their money, or both. More broadly, they’re designed to give scammers access—to a credit card, bank account, proprietary company information, and even physical access to a building or restricted space in the case of tailgating attacks. In this way, social engineering is an attack technique rather than a specific type of attack.

Several types of attacks employ social engineering:

- Phishing scams

- Romance scams

- Imposter scams

- Phony sweepstakes scams

- Employment scams

- Tax scams

- Social media scams

- Tech support scams

The list goes on. Yet those are among the top attacks that use social engineering as a means of hoodwinking their victims. It’s a scammer’s secret weapon. Time and time again, we’ve seen just how effective it can be.

So while many bad actors turn to social engineering tricks to do their dirty work, they share several common characteristics. That makes them easy to spot. If you know what you’re looking for.

How to spot social engineering

1) You receive an urgent or threatening message.

An overexcited or aggressive tone in an email, text, DM, or any kind of message you receive should put up a big red flag. Scammers use these scare tactics to get you to act without thinking things through first.

Common examples include imposter scams. The scammer will send a text or email that looks like it comes from someone you know. And they’ll say they’re in a jam of some sort, like their car has broken down in the middle of nowhere, or that they have a medical emergency and to go to urgent care. In many of these cases, scammers will quickly ask for money.

Another classic is the tax scam, where a scammer poses as a tax agent or representative. From there, they bully money out of their victims with threats of legal action or even arrest. Dealing with an actual tax issue might be uncomfortable, but a legitimate tax agent won’t threaten you like that.

2) You get an incredible offer. Too incredible.

You’ve won a sweepstakes! (That you never entered.) Get a great deal on this hard-to-find item! (That will never ship after you’ve paid for it.) Scammers will concoct all kinds of stories to separate you from your personal information.

The scammers behind bogus prizes and sweepstakes will ask you for banking information or sometimes even your tax ID number to pay out your winnings. Winnings you’ll never receive, of course. The scammer wants that information to raid your accounts and commit all kinds of identity theft.

Those great deals? The scammers might not ship them at all. They’ll drain your credit or debit card instead and leave you tapping your foot by your mailbox. Sometimes, the scammers might indeed ship you something after all—a knock-off item. One possibly made with child labor.

3) Something about that message looks odd.

Scammers will often pose as people you know. That can include friends, family members, co-workers, bosses, vendors or clients at work, and so on. And when they do, something about the message you get will seem a bit strange.

For starters, the message might not sound like it came from them. What they say and how they say it seems off or out of character. It might include links or attachments you didn’t expect to get. Or the message might come to you via a DM sent from a “new” account they set up. In the workplace, you might get a message from your boss instructing you to pay someone a large sum from the company account.

These are all signs that something scammy might be afoot. You’ll want to follow up with these people in person or with a quick phone call just to confirm. Reach them in any way other than by replying to the message you received. Even if it looks like a legitimate account. There’s the chance their account was hacked.

Preventing social engineering con games

How do scammers know how to reach you in the first place? And how do they seem to know just enough about you to cook up a convincing story? Clever scammers have resources, and they’ll do their homework. You can give them far less to work with by taking the following steps.

1. Clean up your personal data online.

Online data brokers hoard all kinds of personal information about individuals. And they’ll sell it to anyone. That includes scammers. Data brokers gather it from multiple sources, such as public records and third parties that have further information like browsing histories and shopping histories (think your supermarket club card). With that information, a scammer can sound quite convincing—like they know you in some way or where your interests lie. You can get this information removed so scammers can’t get their hands on it. Our Personal Data Cleanup scans some of the riskiest data broker sites and shows you which ones are selling your personal info. It also provides guidance on how you can remove your data from those sites and with select products, it can even manage the removal for you.

2. Set your social media accounts to private.

Needless to say, social media says a lot about you and what you’re into. You already know that because you put a part of yourself out there with each post—not to mention a record of the groups, pages, and things that you follow or like. All this provides yet more grist for a scammer’s mill when it comes time for them to concoct their stories. Setting your accounts to private takes your posts out of the public eye, and the eye of potential scammers too. This can help reduce your risk of getting conned.

3. Confirm before you click. Better yet, type in addresses yourself.

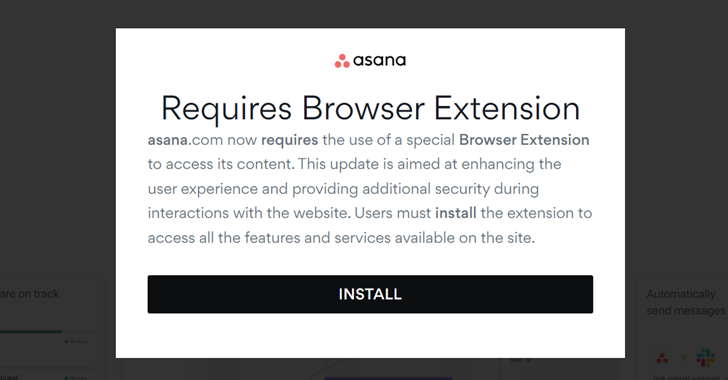

Scammers throw all kinds of bogus links at people in the hope they’ll click and wind up on their scammy websites. They’ll also send attachments loaded with malware—a payload that contains ransomware, spyware, or viruses. If you get a message about one of your accounts, a shipment, or anything that involves your personal or financial info, confirm the sender. Did the message come from a legitimate address or account? Or was the address spoofed or the account a fake? For example, some scammers create social media accounts to pose as the U.S. Internal Revenue Service (IRS). The IRS doesn’t contact people through social media. If you have a concern about a message or account, visit the site in question by typing it in directly instead of clicking on the link in the message. Access your information from there or call their customer service line.

4. Use strong, unique passwords and multi-factor authentication.

The combination of these two things makes it tough for scammers to crack your accounts. Even if they somehow get hold of your password, they can’t get into your account without the multifactor authentication number (usually sent to your phone in some form). A password manager as part of comprehensive online protection software can help you create and securely store those strong, unique passwords. Also, never give your authentication number to anyone after you receive it. Another common scammer trick is to masquerade as a customer service rep and ask you to send that number to them.

5. Slow down. View messages skeptically.

This is the one piece of advice scammers don’t want you to have, let alone follow. They count on you getting caught up in the moment—the emotion of it all. Once again, emotions, urgency, and human nature are all key components in any social engineering con. The moment you stop and think about the message, what it’s asking of you, and the way it’s asking you for it, will often quickly let you know that something is not quite right. Follow up. A quick phone call or face-to-face chat can help you from getting conned.