As

people

get

into

their

70s,

they

stand

to

lose

more

to

fraud

than

any

other

age

group—which

makes

a

strong

case

for

protecting

the

older

people

in

our

lives.

If

you’re

looking

to

protect

them

online,

you

have

several

ways

to

go

about

it.

Our

new

McAfee+

Family

plans

are

one

way,

where

two

adults

and

four

children

get

personalized

online

protection

that

they

can

set

up

and

manage

on

their

own.

With

your

McAfee+

Family

plan

a

simple

invitation,

you

can

rest

easy

that

they’re

protected

against

online

scams

and

other

threats.

And

threats

certainly

face

us

all,

and

hit

older

adults

hardest.

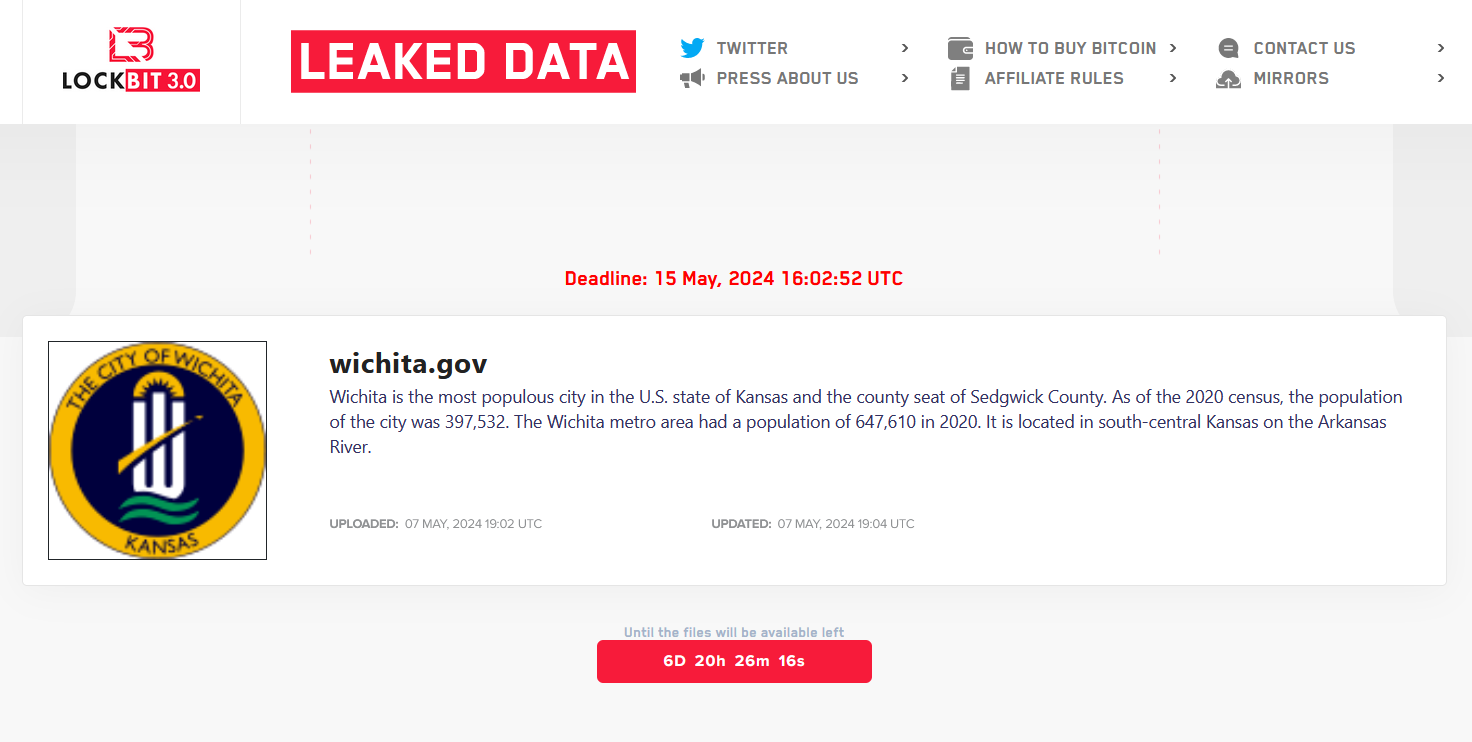

In

the

following

table

courtesy

of

the

U.S.

Federal

Trade

Commission

(FTC),

you

can

see

the

risks

that

adults

faced

in

2022.

While

younger

victims

reported

fraud

loss

at

a

higher

rate,

their

median

losses

were

typically

smaller

than

the

losses

of

older

adults.

By

the

time

victims

reach

their

70s

and

80s,

the

reporting

rate

dropped,

yet

the

median

losses

made

a

significant

leap.

Note

that

these

are

reported

cases

of

fraud,

and

those

reported

to

the

FTC.

In

other

words,

this

represents

just

a

slice

of

the

fraud

that

occurred

in

2022.

Moreover,

as

we’ve

shared

before

in

articles

about

elder

scams,

older

adults

may

be

less

willing

or

able

to

report

a

scam.

The

reasons

vary.

They

may

not

know

how

they

were

scammed

or

they

may

feel

shamed

by

being

scammed—all

of

which

can

lead

to

underreporting.

Moreover,

not

every

scam

report

includes

an

age

range,

which

leads

to

further

underreporting.

Yet

the

case

is

clear.

Scams

pose

a

significant

threat

to

older

adults.

Which

online

scams

are

targeting

grandparents

and

older

adults?

Looking

further

into

the

FTC

data,

older

adults

in

the

U.S.

lost

more

than

$1.6

billion

to

scams

in

2022

across

four

primary

categories:

-

Imposter

scams

–

As

the

name

implies,

these

involve

scammers

masquerading

as

legitimate

businesses,

government

agencies,

or

even

friends

and

family

members.

Regardless

of

the

guise,

the

scammers

want

the

same

thing—to

steal

money

and

personal

information

from

the

victim.

To

do

so,

scammers

may

make

phony

threats

as

they

pose

as

credit

card

agents

or

tax

collectors,

or

they

may

pretend

to

be

a

friend

or

grandchild

in

urgent

financial

need.

In

these

cases,

email

and

social

media

account

for

primary

contact

methods,

and

payments

usually

take

the

form

money

orders

and

gift

cards

as

losses

from

them

are

difficult

to

recover.

-

Online

shopping

scams

–

These

scams

take

in

victims

of

all

ages.

Search

and

social

media

ads

lead

victims

to

bogus

websites

that

sell

unique

or

hard-to-get

items,

often

at

a

greatly

reduced

cost.

However,

once

the

scammers

receive

payment,

they’ll

either

deliver

low-quality

knockoff

goods

or

no

goods

at

all.

In

the

case

of

counterfeit

goods,

these

scams

may

be

a

front

for

illegal

activity

and

may

exploit

child

labor

as

well.

In

the

case

of

non-delivery,

organized

cybercrime

groups

often

run

these

scams,

operating

them

much

in

the

same

way

a

legitimate

business

sells

its

goods—with

marketing

teams,

web

developers,

and

processes

for

receiving

payment.

In

short,

they

can

look

and

act

rather

sophisticated.

-

Sweepstakes

scams

–

Tough

to

win

a

sweepstakes

that

you

never

entered.

But

that

won’t

stop

scammers

from

saying

you

have.

Victims

will

get

an

email

or

a

direct

message

in

social

media

saying

that

they’ve

won

a

prize

and

that

all

they

need

to

do

it

claim

it.

This

is

where

the

scammer

will

ask

the

victim

to

provide

something,

like

personal

information

because

the

scammer

needs

it

determine

their

“eligibility”,

or

their

bank

account

routing

information

so

that

the

scammer

can

“send

the

winnings.”

In

some

cases,

they

may

outright

ask

victims

for

money,

like

a

processing

fee

or

a

payout

for

taxes

on

the

(bogus)

winnings.

-

Tech

support

scams

–

These

scams

target

older

adults

several

ways,

such

as

through

links

from

unsolicited

emails,

pop-up

ads

from

risky

sites,

or

by

spammy

phone

calls

and

texts.

Here,

the

scammer

will

pose

as

tech

support

from

a

known

and

reputable

brand

and

inform

the

victim

that

they

have

an

urgent

issue

with

their

computer

or

device.

While

the

device

is

actually

in

fine

working

order,

the

scammer

offers

to

“fix”

it

for

a

fee.

With

permission

to

fix

the

device

given,

the

scammer

either

does

nothing

or,

more

maliciously,

installs

malware

like

adware

or

spyware

on

the

otherwise

healthy

device.

Helping

the

grandparents

and

older

adults

in

your

life

avoid

online

scams.

So

many

scams

fail

to

pass

the

sniff

test.

The

moment

you

scrutinize

the

incredible

offer

plastered

on

that

ad

or

question

why

a

so-called

tax

collector

would

hound

you

on

social

media,

something

immediately

smells

fishy.

Yet

people

don’t

always

catch

that

whiff.

People

of

all

ages.

Not

just

the

elders

in

our

lives.

One

way

we

can

help

everyone

stay

safer

online

is

through

conversation.

The

knowledge

that

comes

from

a

good,

ongoing

conversation

about

life

online

provides

them

with

one

pillar

of

protection.

Talking

about

how

they

spend

their

time

online

and

the

types

of

scams

that

are

out

there

arms

them

with

the

savvy

they

need

to

spot

a

scam.

That

will

help

them

take

that

crucial

moment

when

faced

with

a

possible

scam,

a

crucial

moment

to

consider

if

that

ad,

email,

or

direct

message

is

indeed

bogus.

The

second

pillar

comes

from

comprehensive

online

protection.

Today’s

protection

goes

far

beyond

antivirus.

It

protects

devices

the

privacy

and

the

identity

of

the

people

using

them.

In

the

case

of

our

McAfee+

Family

plans,

they

protect

up

to

six

people

from

viruses,

credit

card

fraud,

and

identity

theft

with

tailored

guidance

as

they

do

what

they

do

online.

With

an

elder

on

your

family

plan,

you

can

see

which

devices

they’ve

installed

protection

on,

so

you’ll

know

they’re

protected.

More

specific

to

some

of

the

scams

we

talked

about,

it

can

help

block

older

adults

from

accessing

messages.

Further,

it

can

help

prevent

scam

calls

and

texts

in

the

first

place.

Personal

Data

Cleanup

spots

and

removes

their

personal

info

from

risky

data

broker

sites

that

spammers

use

to

find

victims.

And

if

their

personal

information

has

been

compromised,

our

identity

monitoring

alerts

them

if

their

data

is

found

on

the

dark

web,

an

average

of

10

months

ahead

of

similar

services—and

get

expert

guidance

about

what

to

do

next.

Our

identity

theft

protection

and

recovery

service

identity

and

credit

if

the

unexpected

happens

to

them.

<h2>Adding

a

parent

to

your

family

plan.

Adding

someone

to

your

McAfee+

Family

plan

is

practically

as

simple

as

typing

in

an

email

address.

Think

of

it

as

sending

an

invitation,

one

where

everyone

gets

their

own

personalized

protection

with

their

own

unique

login.

This

way,

each

member

of

the

family

can

set

up

and

manage

their

own

protection

for

their

identity,

privacy,

computers,

and

phones.

With

this

invitation,

they’ll

see

that

it

comes

from

you

and

that

all

they

need

to

do

to

start

their

protection

is

to

click

the

link—no

extra

charges

or

fees.

They’re

simply

part

of

your

plan

now.

From

there,

they

can

download

their

protection,

set

up

their

devices,

and

consult

their

McAfee

Protection

Score

to

see

how

secure

they

are.

Then

simple

instructions

make

it

easy

to

set

up

and

fix

gaps

to

improve

their

online

security

so

that

they’re

safer

still.

In

all,

it’s

a

highly

straightforward

process,

for

you

and

members

of

your

family.

Protect

your

family

from

scams

online

with

the

right

plan

in

place.

Spending

any

time

online

calls

for

online

protection,

no

matter

what

age

you

are.

While

threats

may

look

different

across

different

age

groups,

every

family

member

faces

them.

Another

thing

everyone

has

in

common

is

that

every

family

member

can

protect

themselves

from

threats,

far

more

thoroughly

now

than

before.

Comprehensive

online

protection

has

evolved

far

beyond

antivirus.

It

protects

the

person,

which

is

important

because

that’s

who

scammers

target.

They

target

people,

so

they

can

invade

their

privacy,

steal

their

personal

information,

or

simply

rip

them

off.

Put

plainly,

knowing

what

today’s

scams

look

like

and

using

comprehensive

online

protection

offer

a

one-two

punch

in

the

defense

against

online

scams.

You

have

several

options

to

get

it

for

the

older

adults

in

your

life,

our

new

McAfee+

Family

plans

being

one

of

them.

Whichever

route

you

take,

putting

your

family’s

protection

plan

in

place

will

absolutely

reduce

the

chances

of

someone

you

love

getting

stung

by

a

scam.