A

new

version

of

the

Prilex

POS

malware

has

found

a

novel

way

to

steal

your

credit

card

information.

WhataWin/Adobe

Stock

According

to

Kaspersky,

Prilex

is

a

Brazilian

threat

actor

that

initially

began

in

2014

as

an

ATM-related

malware

and

later

switched

to

modular

point-of-service

malware.

The

threat

actor

was

responsible

for

one

of

the

biggest

attacks

on

ATMs

in

Brazil,

infecting

and

jackpotting

more

than

1,000

machines

and

cloning

more

than

28,000

credit

cards

used

in

the

ATMs.

SEE:

Mobile

device

security

policy

(TechRepublic

Premium)

Prilex

is

particularly

experienced

with

payment

markets,

electronic

funds

transfer

software

and

protocols,

and

the

threat

actor

has

recently

updated

its

POS

malware

to

block

contactless

transactions

to

steal

your

credit

card

information.

Jump

to:

What’s

new

in

the

latest

Prilex

malware

Contactless

payment

methods

have

become

incredibly

popular,

especially

since

the

COVID-19

pandemic

when

people

wished

to

touch

as

public

surfaces

as

possible.

Such

payments

require

the

credit

card

to

be

really

close

to

the

payment

device,

which

is

typically

a

POS

terminal.

As

contactless

payments

are

not

handled

by

the

POS

terminal

in

the

same

way

as

usual

payments,

it’s

not

possible

for

cybercriminals

to

abuse

and

make

fraudulent

use

of

the

system.

This

resulted

in

cybercriminals’

POS

malware

seeing

a

huge

decrease

in

the

number

of

transactions

it

could

abuse.

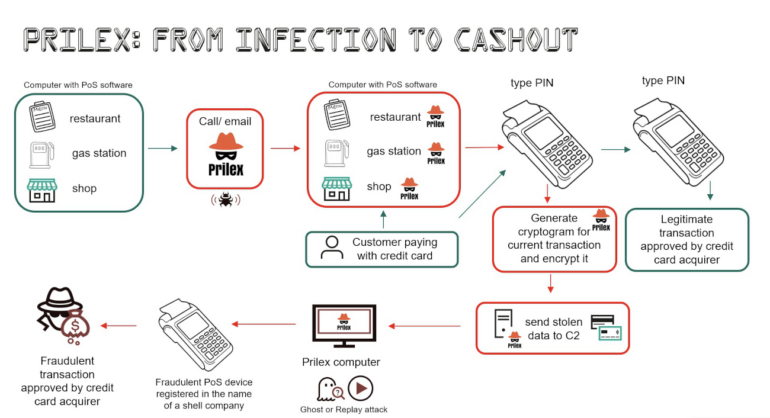

Prilex

malware

developers

have

found

a

way

to

deal

with

this

problem:

The

malware,

once

it

sees

a

contactless

transaction

happen,

blocks

it.

The

PIN

pad

then

tells

the

user

that

there

is

a

contactless

error

and

that

the

payment

needs

to

be

done

by

inserting

the

credit

card.

Once

the

victim

pays

by

card,

a

GHOST

transaction

fraud

can

be

operated

by

Prilex.

In

GHOST

transactions,

the

malware

sits

on

the

device,

intercepting

all

communications

between

the

POS

software

and

the

PIN

pad.

Once

a

transaction

is

ongoing,

the

malware

intercepts

the

transaction

content

and

modifies

it

in

order

to

capture

the

credit

card

information

and

request

new

EMV

cryptograms

to

the

victims

card.

The

new

EMV

cryptogram

enables

the

attacker

to

initiate

a

new

fraudulent

transaction

from

a

POS

device

they

own

(Figure

A).

Figure

A

Kaspersky.

GHOST

transaction

attack

scheme

as

executed

by

the

Prilex

threat

actor.

How

do

POS

malware

infections

work?

POS

malware

is

not

your

average

malware.

Developing

it

requires

a

deep

understanding

of

the

whole

payment

market

as

well

as

its

protocols,

tools

and

deployment.

As

such

malware

is

useless

on

usual

endpoints,

it

needs

to

be

executed

on

the

computers

who

actually

run

the

POS

software

and

deal

with

payments.

The

cybercriminals

behind

advanced

POS

malware

cannot

just

send

phishing

emails

to

infect

computers;

they

need

to

target

specific

people

and

use

social

engineering

schemes

to

entice

the

victim

to

install

a

legitimate

remote

desktop

application

before

infecting

it.

This

explains

why

the

fraudsters

generally

pretend

to

be

technicians

who

need

to

update

the

legitimate

POS

software.

How

to

protect

your

organization

from

this

threat

The

end

customer

can

not

do

anything

against

the

threat,

as

it

happens

on

infected

devices

that

they

can’t

control.

All

protection

must

come

from

administrators

of

POS

software.

As

a

company

using

POS

systems,

establish

a

detailed

process

with

the

POS

provider

in

order

to

avoid

any

social

engineering

scams.

All

contacts

between

the

POS

software

customer

and

the

POS

software

provider

need

to

follow

specific

rules

that

should

be

discussed

over

a

secure

channel

and

known

by

anyone

who

could

access

the

devices

running

the

POS

software.

Should

any

cybercriminal

call

and

pretend

to

be

an

employee

of

the

POS

software

supplier,

this

would

help

to

immediately

discover

them.

Security

solutions

should

be

deployed

on

all

devices

running

POS

software

to

try

to

detect

malware

infection.

As

information

is

sent

from

an

infected

POS

device

to

an

attacker

owned

C2,

network

communications

should

also

be

monitored

in

order

to

detect

any

suspicious

activity

that

could

be

a

communication

between

a

malware

and

a

C2

server.

Finally,

all

software

and

operating

systems

should

always

be

up

to

date

and

patched

in

order

to

avoid

compromise

by

common

vulnerabilities.

Disclosure:

I

work

for

Trend

Micro,

but

the

views

expressed

in

this

article

are

mine.