Fraud Prevention Is a Latency Game

There is a time window for every act of online fraud. When a transaction occurs, a fraud system must review it and decide if it’s legitimate before the payment clears or if the account could be compromised.

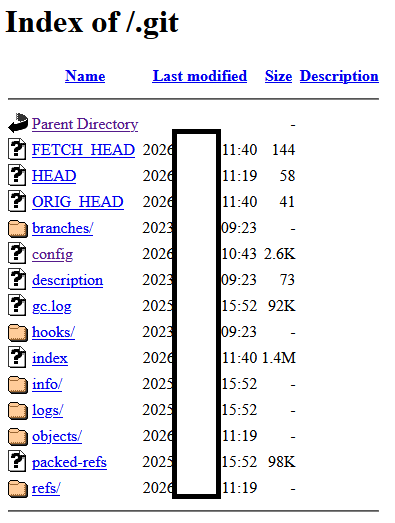

Pretend Disk Format: PDFs harbor new dangers

There is a time window for every act of online fraud. When a transaction occurs, a fraud system must review it and decide if it’s legitimate before the payment clears or if the account could be compromised. That window happens in a blink, often one-tenth of a second or less. During that time, models must get the data, apply logic, and provide a decision. The longer the system hesitates, the higher the losses.

At its core, fraud prevention is a latency problem. In most digital transactions, organizations budget 50 to 100 milliseconds for the system to complete the entire decision process. During that time, from when a user clicks on a transaction to when the system produces an answer, it must account for user authentication, model scoring, and data lookup. Each millisecond to complete any of these actions takes away from the time available for the algorithm to decide if it’s a valid transaction.

Managing the Latency Budget

Engineers refer to the decision window of 50 to 100 milliseconds as a latency budget, a limited amount of time that must be allocated across all the moving parts of the transaction. So, if data access has consumed 30 of a 50-millisecond budget, there’s little room left for the decisioning model. To improve the budget, the team is likely to simplify models, increasing the chances that a bad transaction will slip through or that valid transactions will be rejected. If the infrastructure performance is improved, it gives some of that time back to the model, and the algorithm then has a better chance of making the right decision.

In a large-scale system processing millions of simultaneous events, every transaction is pulling from the same limited resource. Achieving consistency at the submillisecond level is hard, but inconsistency is worse than being slow. A single slow response can delay a decision long enough for fraud to occur.

Layering Models for Deeper Decisions

Fraud detection systems typically don’t rely on a single algorithm. Instead, they execute several models, each with escalating complexity and sophistication. The first pass involves using fast and inexpensive checks that address routine claims, such as ordinary recurring payments or other known customer behaviors. If the transaction passes this stage, it goes through immediately. If it raises a red flag, a more detailed model comes into play, pulling additional data. Only a small subset advances to the final stage, which examines dozens of features or runs a deep learning model.

This approach strikes a balance between accuracy and throughput, but it relies on the ability to transfer data to models quickly. Each stage requires its own specific features, such as account history, device data, and transaction frequency, which must be retrieved from a database. If the time to fetch those features is poor and response time suffers, the whole chain backs up. The faster the system loads the data, the easier it becomes to keep the lightweight models efficient and to support the heavier ones when needed.

Maintaining Consistency at Scale

Latency creates a limitation on how much insight the model can draw from. If systems slow down, teams will reduce the number of features or skip sophisticated checks to meet time limits. The trade-off is that a slower data path offers shallower analysis. Conversely, low and predictable response time allows the models to look deep and wide, analyzing more variables while staying within the decision window.

At enterprise scale, the impact of latency becomes apparent. For example, LexisNexis Risk Solutions reduced decision latency from an average of approximately 120 milliseconds to around 30 milliseconds while processing tens of millions of live transactions. The improvement tightened the detection window and reduced the number of approvals for fraudulent transactions in its identity-verification network. Numbers like these highlight the significant impact that infrastructure design has on fraud outcomes.

Pressure is rising as fraudsters increasingly refine their tactics. Criminal networks are now utilizing automation and AI to access systems more quickly than ever. They develop synthetic identities, coordinate fraud rings, and cash out in minutes. As these techniques evolve, fraud systems need to respond with the same speed and sophistication — a smaller latency budget. The technical challenge is to build better models while ensuring the architecture can execute those models in real time.

Balancing Cost and Accuracy

The complete elimination of fraud will never be possible in any system. All organizations accept a small amount of loss as part of business as usual. Chasing down every suspicious transaction often costs more than the loss that would occur. You want to invest enough time and compute to block the highest-risk activities while ensuring legitimate transactions are permitted without friction. When a system is architected around a defined latency budget, it creates a framework for the teams to discuss trade-offs explicitly. It helps define how many milliseconds are available to spend on each step in the process, and where optimizing latency will have the most impact.

Managing and understanding latency isn’t only relevant to engineering. Risk analysts, data scientists, and infrastructure teams are all accountable for how quickly the system can make a decision. Defining service-level targets for latency ensures that teams are aligned on priorities. When teams understand that every millisecond over the defined latency target costs accuracy, it’s easier to justify performance work that supports the system behind the scenes.

Treating Latency as a Strategic Priority

In a successful fraud prevention program, speed of execution will be more important than the algorithms used. Latency affects how much data a model can process, how far it can reason, and, ultimately, whether it has sufficient time to stop a transaction before the money is moved. Organizations that treat latency as a first-class concept within their fraud strategy will be the ones that can keep pace as activity and risk grow.