Australia’s newest and independent airline, Bonza has selected B2B digital payments provider Monoova to replace its now obsolete POLi Payments systems.

Christian Westerlind Wigstrom.

The low-cost airline selected Monoova to implement PayTo’s digital direct debit payment option for consumers paying online for their flights or travel booking, without credit card or other surcharge fees.

Back in July, Australia Post announced the closure of the domestic operations of POLi Payments, by the end of September.

The service was used for customers to make near real-time payments including depositing money with cryptocurrency exchanges.

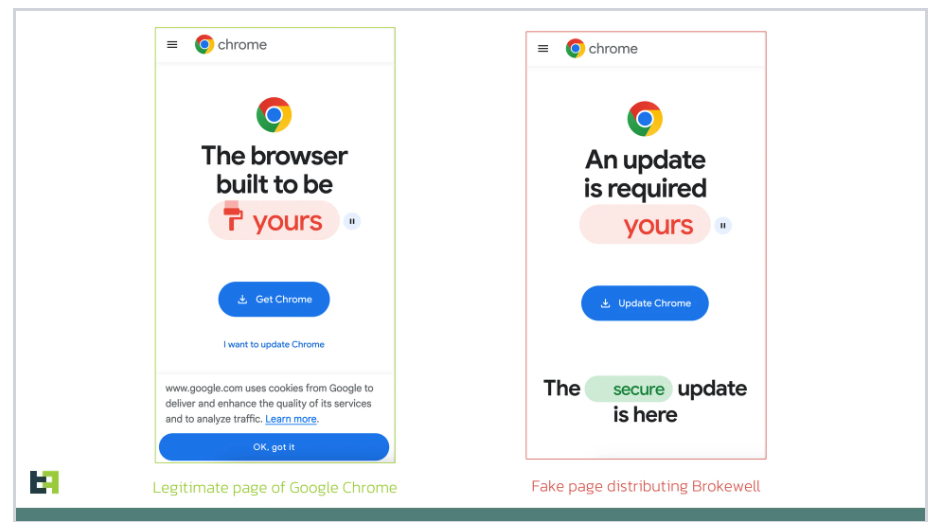

It did however, receive criticism from banks as it required users to hand over their bank account login credentials, so POLi could initiate payments on their behalf.

With the service now closed, Monoova set out to position itself as an alternative to POLi Payments.

Monoova said Bonza’s move from POLi to PayTo is “likely to be the first of many in the aviation industry” as “corporate Australia becoming increasingly aware of the benefits of PayTo over traditional payment methods.”

Monoova CEO Christian Westerlind Wigstrom said “the travel industry embracing real-time debit is a pivotal moment in the evolution of payments in Australia.”

“We fully expect other industries to follow suit,” he said.

“PayTo will quickly become the preferred payment method for a wide array of online transactions.”

He said the move to PayTo will be driven by more than the need for fast transactions, but also the need for “security and the overall customer experience”.

“It significantly decreases vulnerability to fraud and safeguards consumers’ financial well-being. No sensitive credit card information is shared.

“It offers businesses instantaneous transaction tracking and financial transparency, which leads to multiple operational efficiencies and improved customer relationships.

“It’s a win-win for both consumers and businesses in every single way. Very soon, we will struggle to remember life before PayTo.”

PayTo was developed by NPP Australia and the finance industry, and allows businesses to initiate payments from their customers’ bank accounts.

The likes of CBA, Great Southern Bank and Bendigo Bank were some of the first to enable the new functionality.

By March over 50 organisations were live with the PayTo service with banks and financial institutions either onboarded or on-track to meet an April activation deadline.