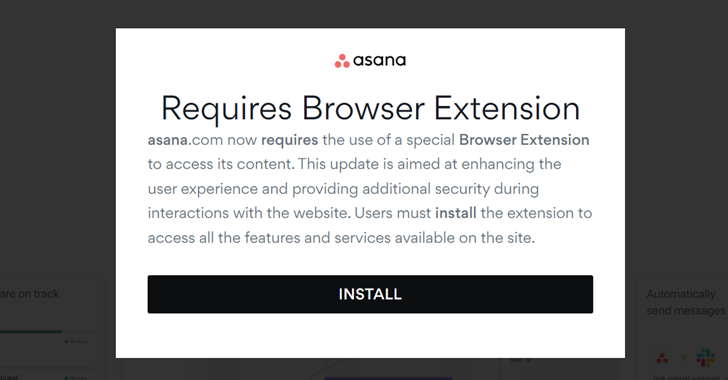

The Australian Securities and Investments Commission (ASIC) intends to focus on technology and operational resilience in the financial sector in the coming year.

The regulator announced on Tuesday its overall enforcement priorities and its intentions for 2024.

Of the 12 priorities, ASIC deputy chair Sarah Court said “technology and operational resilience for market operators and market participants” will be a key focus.

Court said at the ASIC Annual Forum said on Tuesday that many of “the priorities have a consumer or retail investor focus”.

“This should not signal any lessening in our recognition that our enforcement work is critical to maintaining properly functioning markets,” she said.

“Our enduring priorities – those forms of misconduct that we will always prioritise given the potential harm that arises from them – continue to include insider trading, market manipulation and continuous disclosure.”

She continued: “In 2024 we will specifically focus on technology and operational resilience for market operators and market participants, including compliance with the new market integrity rules.”

Court said ASIC had achieved its priorities for 2023 “by any measure”.

From a tech perspective, these covered the crypto sector and a crackdown on scams, both of which are no longer listed as priority focus areas in 2024.

However, an ASIC spokesperson told iTnews that “crypto and scams have come out of the enforcement priorities, but are still priorities for ASIC as a whole”.

“For crypto specifically, ASIC has a number of civil penalty actions before the courts and the outcomes of these cases will help understand the regulatory perimeter,” the spokesperson said.

“We will continue to support the development of an effective regulatory framework for crypto and monitor market developments.”

In a release, another two new priorities were added around the superannuation industry including emphasis on failures in the member services and misconduct around superannuation balances.