Strengthening Fraud Prevention with Real-Time Mobile Identity Signals

Fraud is growing faster than businesses can keep up with, especially as customers move more of their interactions into digital channels.

In financial services, for example, research by LexisNexis Risk Solutions shows 63% of North American financial firms reported an overall fraud increase of 6% or more over a one-year period, with digital channels accounting for half of their overall fraud losses. The 2024 study, “True Cost of Fraud,” also indicated that costs resulting from fraud are staggering: For U.S. firms, every dollar of fraud loss has an operational cost of $4.41.

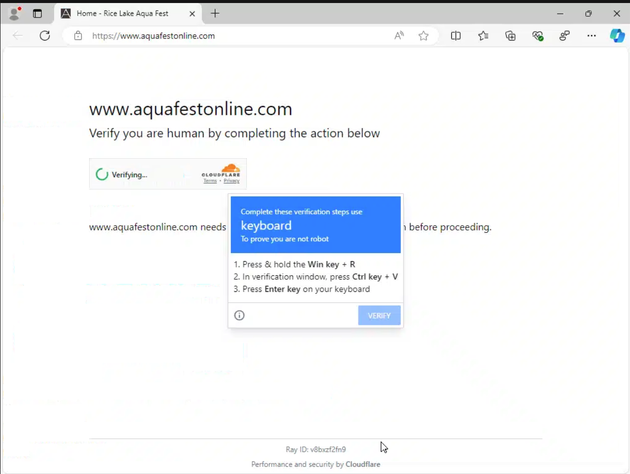

Safeguarding digital environments is essential, but many fraud-prevention measures inadvertently create customer friction. Lengthy, multi-layered verification steps slow the registration process and create a poor customer experience. As a result, that means user drop-offs during onboarding and conversion.

Businesses can’t afford to choose between security and customer experience. Preventing fraud, protecting reputation, and maintaining trust all depend on identity verification that is accurate, resilient, and fast enough to operate in real time.

Preventing fraud, protecting reputation, and maintaining trust all depend on identity verification that is accurate, resilient, and fast enough to operate in real time

As fraud grows more sophisticated, the challenge for risk teams moves past detecting suspicious behavior. The bigger task today is confidently verifying identity in an environment where digital interactions have outpaced traditional signals. Behavioral analytics and machine-learning models can help, but they still rely on probability and inference. Today’s most effective fraud strategies go deeper, anchoring decisions in deterministic identity signals that provide authoritative, real-time insight into who’s on the other end of a transaction.

The case for deterministic identity signals in modern fraud prevention

Today, security teams operate according to a fundamental truth: you can’t stop identity-driven attacks with tools that only approximate identity. Probabilistic models, irrespective of how elegant, are still built on inference. They analyze behavioral patterns, device fingerprints, or transaction histories to guess whether a user is legitimate. These signals serve a purpose, but they struggle against today’s most challenging threats: synthetic identities, SIM-swap-enabled account takeovers, sophisticated social engineering, and organized fraud rings that continuously test and tune their tactics.

Why probabilistic approaches fall short

Probabilistic models tend to degrade over time. Fraudsters learn the patterns needed to score as “good,” and machine learning models, if they aren’t retrained frequently, continue to approve them. This leads to model drift, false negatives, and costly downstream losses. At the same time, fraud teams face pressure to minimize false positives that create friction and drive away legitimate customers.

The reality for security teams is that probability-based fraud tools force them into a tradeoff between security and conversion, particularly in digital channels where identity assurance is weakest.

Reducing fraud by knowing who you’re dealing with

A more reliable strategy is to anchor fraud prevention to deterministic identity signals. These are the signals tied directly to a verified individual, rather than inferred from patterns or historical behavior.

Deterministic identity signals answer a simple but critical question: Is this person who they claim to be, right now, using the device and phone number that actually belongs to them?

When based on real, authoritative data (such as telco network intelligence and phone-number-based identity tokens), deterministic signals offer several advantages:

- Identity Accuracy: They confirm attributes that cannot be faked or easily manipulated.

- Real-Time Insight: They reflect live conditions, like SIM swap events, call-forwarding changes, device changes, and other risk indicators.

- Consistency: They do not degrade over time or drift the way a behavioral model does.

- Resilience Against Evasion: Fraudsters cannot “teach themselves” how to look legitimate to a deterministic system.

Identity signals: The foundation of a smarter fraud strategy

Identity signals, especially those derived from the mobile ecosystem, provide the most reliable, real-time view of whether a customer’s claimed identity aligns with what’s happening behind the scenes. These include:

- Phone possession signals (is the device truly in the user’s physical possession?)

- SIM swap indicators (was the phone number recently compromised?)

- Line tenure and velocity checks (is this number stable or newly risky?)

- Carrier network insights (is the number behaving normally on the network?)

- Phone-number-to-identity continuity (does this number consistently belong to the same person over time?)

Unlike probabilistic behavioral signals, these checks do not rely on guesswork or pattern matching. They can definitively validate whether a user’s digital identity matches the identity tied to their mobile presence.

How Prove enables real-time, resilient fraud defense

Fraud is increasingly identity-driven, and as a result, probability alone is no longer enough to accurately discern between legitimate and fraudulent users. Deterministic, mobile-based identity signals give fraud teams the clarity and confidence they need to make accurate decisions in real time, without compromising customer experience.

Prove makes this possible by delivering phone-centric identity intelligence and trusted mobile signals that enable businesses to verify customers instantly, accurately, and securely, at onboarding and beyond.

By grounding fraud prevention in authoritative, hard-to-fake signals, Prove helps organizations outpace evolving threats, reduce operational risk, and build a foundation of trust that strengthens every digital interaction.

###

Trusted by 1,500+ leading companies to reduce fraud and improve consumer experiences, Prove is the world’s most accurate identity verification and authentication platform. To learn more, go to prove.com.

Access Prove on the AWS Marketplace, or learn more about why Prove and AWS are better together.