Everyday, you probably process payments via credit and debit cards. However, given the abundance of sensitive information, it is crucial to have strong defenses against cyber attackers. Fortunately, there exists a standardized set of precautions to thwart fraud.

These protective measures are termed the Payment Card Industry Data Security Standard (PCI DSS). To simplify, people often refer to a business as “PCI compliant,” indicating adherence to these stringent security measures enforced by major credit card companies.

Let’s delve into the importance of staying PCI-compliant for your small business.

Insights into PCI Compliance

PCI compliance delineates security guidelines aimed at safeguarding cardholder data during transactions. These standards were introduced in 2004 by the Payment Card Industry Security Standards Council (PCI SSC), comprising major credit card firms like Visa, MasterCard, American Express, Discover, and JCB.

Any entity handling credit card details should comply with these mandates. Besides safeguarding consumers, PCI compliance also shields businesses. By adhering to these protocols, the risk of data breaches and credit card fraud is significantly reduced. Customers also place greater trust in security-conscious organizations. This amalgamation of advantages enhances your organization’s stability and performance.

The Cruciality of PCI Compliance for Small Firms

Compliance with these stringent security fundamentals yields tangible benefits. Here are the key reasons behind compliance:

- Secures Customer Data: PCI compliance guarantees secure handling of customer data, minimizing the risk of detrimental data breaches, providing peace of mind to both you and your customers.

- Prevents Financial Penalties: Non-compliance may lead to hefty fines from credit card companies or financial institutions, potentially reaching six-figure sums, which can rapidly cripple a small enterprise.

- Builds Customer Confidence: Gaining a person’s trust requires effort and time. PCI compliance expedites this process by instilling confidence in your customer base.

Understanding Vital PCI Compliance Requirements

PCI DSS encompasses twelve core requirements. While some mandates demand technical expertise for implementation, all are vital for ensuring a secure payment ecosystem.

Let’s examine each fundamental obligation.

- Establish and Preserve a Secure Network: This stage involves deploying firewalls to safeguard data and prevent unauthorized network access.

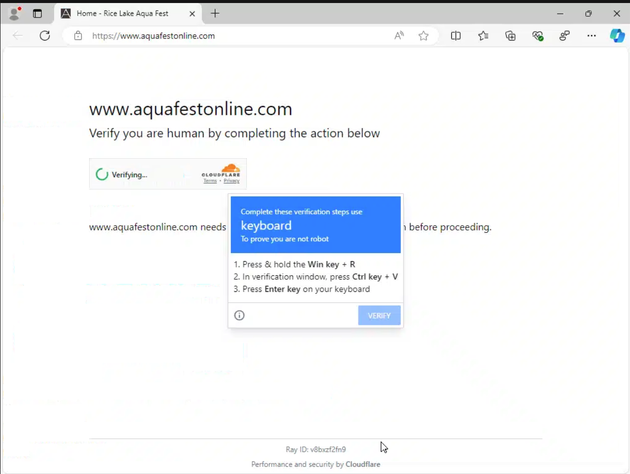

- Utilize Strong Passwords and Security Configurations: Refrain from using default or feeble passwords for systems and devices. Opt for robust, unique passwords that are hard to crack.

Further Reading: Creating Secure Passwords

- Safeguard Stored Cardholder Data: Encrypt sensitive details like credit card numbers when storing them. Store only essential data for business operations and ensure its security.

- Encrypt Cardholder Data Transmission: Employ encryption protocols like SSL or TLS to secure data transmitted over public networks.

- Deploy and Update Anti-Virus Software: Anti-virus tools help thwart malware and other threats from compromising your systems. Keep this software updated to combat emerging threats effectively.

- Establish and Maintain Secure Systems and Applications: Regularly update software, including security patches, to safeguard against known vulnerabilities.

- Restrict Access to Cardholder Data: Limit data access to staff requiring it for their roles, reducing the chance of unauthorized access.

- Verify and Control Access to System Components: Implement user IDs and passwords to monitor cardholder data and system component access.

- Limit Physical Access to Cardholder Data: Secure any physical cardholder data copies, like receipts, ensuring access is restricted to authorized individuals.

- Monitor Network Resource Access: Employ logging mechanisms to track network resource and cardholder data access. Regularly check these logs for suspicious activities.

- Regularly Assess Security Systems and Processes: Conduct vulnerability scans and penetration tests to identify and rectify security system weaknesses.

- Maintain an Information Security Policy: Create a documented security policy outlining your organization’s approach to PCI compliance and data protection.

The Various Tiers of PCI Compliance

PCI compliance is classified into four levels based on your annual credit card transaction volume. Familiarizing yourself with these tiers aids in determining which requirements are applicable to your situation.

| Level 1 | Over 6 million card transactions annually across all sales channels. | Mandatory annual in-person assessment by a Qualified Security Assessor (QSA). |

| Level 2 | 1 to 6 million card transactions per year from all sales channels. | Annual completion of a Self-Assessment Questionnaire (SAQ) and quarterly network scans by an Approved Scanning Vendor (ASV). |

| Level 3 | 20,000 to 1 million e-commerce transactions annually. | Completion of an annual SAQ and quarterly network scans. |

| Level 4 | Less than 20,000 e-commerce transactions annually, OR 1 million or fewer transactions across all sales channels. |

Annual SAQ completion and quarterly scans. |

Many small businesses fall under Level 3 or Level 4, making it manageable for them to handle compliance with appropriate tools and guidance.

Realizing PCI Compliance for your Small Enterprise

Embarking on the journey towards PCI compliance may seem daunting. However, each phase is feasible even for smaller entities. Here’s a comprehensive guide to aid you in commencing:

Step 1: Evaluate your PCI compliancelevel

Determine your standing based on the volume of credit card transactions your business handles each year. This number dictates the type of evaluation and paperwork you must complete.

Step 2: Finish a self-assessment survey (SAS)

The SAS is a set of queries that evaluate your organization’s security protocols. Select the document that aligns with your business structure and payment procedures. For instance, SAS A is appropriate for merchants who delegate all cardholder data operations to an external entity.

Suggestion: SASs and relevant materials are available on the PCI Security Standards Council website.

Step 3: Carry out a vulnerability check

Collaborate with an approved scanning provider (ASP) to carry out a vulnerability assessment on your systems. This process identifies security vulnerabilities in your network.

Step 4: Rectify any security deficiencies

Evaluate the SAS and vulnerability audit findings to resolve any identified vulnerabilities. This could involve enhancing your firewall, strengthening password procedures, or implementing more robust encryption.

Step 5: Present attestation of conformity (AOC)

Once you have successfully completed the required evaluations and audits, submit your attestation of conformity to your financial institution or payment service provider. This record demonstrates that you have met the PCI DSS requirements.

Step 6: Sustain Ongoing Conformity

Maintaining PCI conformity requires continuous effort. Regularly oversee your security practices, conduct quarterly scans, and keep your software and systems up to date to remain compliant.

Related: 14 PCI Compliance security best practices for your business

Debunked Common Myths About PCI Conformity

There are numerous erroneous statements and rumors revolving around PCI conformity. Let’s debunk the most common assertions.

- “PCI Conformity is Only for Large Corporations”: Entities of any scale must adhere to PCI DSS in order to process bank cards. In reality, smaller establishments are often more enticing to criminals due to an assumed lack of security.

- “PCI Conformity Ensures Full Security”: PCI conformity is just one component of your broader data security strategy. While not completely foolproof, it significantly reduces the likelihood of falling prey to fraud. Data breaches can still occur, but it serves as a substantial protective measure.

- “PCI Conformity is Too Costly for Small Enterprises”: Smaller businesses benefit from a more lenient (and less expensive) approval process. Regardless of size, prevention is better than cure. A data breach could lead to substantial costs and harm to reputation, making PCI conformity a prudent and economical path.

Frequently Asked Questions

What is the meaning of PCI?

PCI stands for Payment Card Industry, a term that denotes the consortium of companies handling bank card transactions, with prominent names including Visa, Mastercard, and Discover.

What does PCI conformity signify?

PCI conformity involves adhering to the criteria outlined in the Payment Card Industry Data Security Standard (PCI DSS). The objective of compliance is to operate your business securely, safeguard consumer data, and minimize the risk of fraud and cyber threats.

What are the four tiers of PCI conformity?

The four tiers of PCI conformity are structured around the volume of credit card transactions processed annually by a business. Here are the requirements for each tier:

- Level 1: More than 6 million transactions annually.

- Level 2: 1 to 6 million transactions per year.

- Level 3: 20,000 to 1 million e-commerce transactions per year.

- Level 4: Less than 20,000 e-commerce transactions or up to 1 million transactions across all channels annually.

Is PCI conformity a legal mandate?

PCI conformity is not a legal requirement but is mandated by credit card companies and financial institutions. Failure to comply can result in fines, higher transaction fees, or even suspension from the payment service provider.

Can I undertake PCI conformity independently?

Yes, small business proprietors can attain PCI conformity autonomously. Businesses with fewer than 20,000 e-commerce transactions per year or less than one million transactions across any sales channels have more lenient compliance prerequisites. If your business falls within either of these categories, you are more likely to successfully manage PCI compliance on your own.