Federal Agency Establishes Sham Digital Currency to Unveil Extensive Crypto Market Manipulation

The Department of Justice (DoJ) in the United States has disclosed arrests and accusations against multiple individuals and organizations involved in allegedly distorting digital asset markets as part of an extensive deceitful initiative.

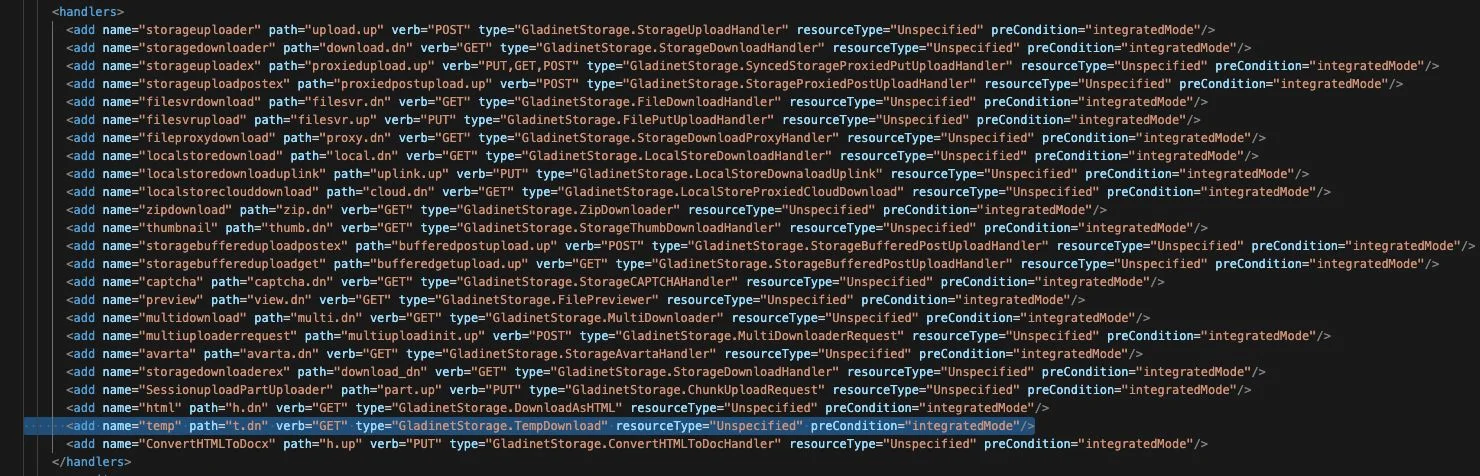

The legal enforcement move – named Operation Token Mirrors – comes after the Federal Bureau of Investigation (FBI) decided to craft its own digital currency token and established a business named NexFundAI.

NexFundAI, as indicated on the website, was promoted as revolutionizing the “convergence between finance and artificial intelligence” with the goal of “forming a cryptocurrency token that not only functions as a secure store of value but also acts as a driver for positive change in the field of AI.”

“Three market creators — ZM Quant, CLS Global, and MyTrade — and their staff are accused of engaging in wash trading activities or conspiring to wash trade for NexFundAI, a digital currency firm and token designed under the supervision of law enforcement as part of the government’s inquiry,” the DoJ stated.

“A fourth market creator, Gotbit, its Chief Executive Officer, and two of its directors are similarly accused of executing a comparable stratagem.”

A sum of 18 individuals and entities have been entangled in the investigation, with five defendants either admitting culpability or consenting to do so. Three other defendants have been apprehended in the U.S. state of Texas, the U.K., and Portugal.

More than $25 million in digital currency has also been seized, and numerous automated trading programs involved in wash trading (also known as circular trading), which involves the illicit act of buying and selling the same financial instruments to fabricate artificial market momentum, for approximately 60 distinct cryptocurrencies have been shut down.

Court filings suggest that the offenders operating the digital currency firms engaged in fake transactions using their personal tokens to create the illusion that they are lucrative investments in an effort to attract new investors and buyers, consequently artificially boosting the tokens’ trading values.

The individuals then offloaded their tokens at the inflated prices, a fraudulent plan recognized as pump-and-dump, with the intent of illegally benefiting from the financial wrongdoing.

The subsequent individuals and digital currency entities have been indicted –

- Aleksei Andriunin, Fedor Kedrov, Qawi Jalili, Gotbit Consulting LLC (Gotbit)

- Riqui Liu, Baijun Ou, ZM Quant Investment LTD (ZM Quant)

- Andrey Zhorzhes, CLS Global FZC, LLC (CLS)

- Liu Zhou, MyTrade MM

- Manpreet Kohli, Haroon Mohsini, Nam Tran, Max Hernandez, Russell Armand, Vy Pham, Saitama LLC (Saitama)

- Robo Inu Finance (Robo Inu)

- Michael Thompson, VZZN, and

- Bradley Beatty, Lillian Finance LLC (Lillian Finance)

“Today’s enforcement actions underscore, once again, that small-scale investors are falling prey to deceitful practices by established entities in crypto asset markets,” Sanjay Wadhwa, deputy director of the SEC’s Enforcement Division, commented.

“With alleged promoters and self-proclaimed market creators joining forces to target the investment public with false guarantees of returns in the crypto markets, investors should be cautious as they may encounter unfair disadvantages.”