One of the most favored coding languages globally is Java. Being versatile, user-friendly, easy to grasp, and secure, this object-oriented language holds a position as one of the top four programming languages worldwide and has seamlessly integrated into business applications globally.

But since 2019, alterations made by Oracle, the provider of Java Development Kit, in terms of licensing new versions have prompted companies to reassess their use of Java. Many APAC businesses are now migrating towards OpenJDK alternatives like Azul Systems.

Azul’s Chief Technology Officer, Gil Tene, shared that their Java solutions, catering to esteemed organizations such as Netflix, Mastercard, Salesforce, Workday, and Adobe, assist clients in managing Java effectively while optimizing cloud expenses and mitigating Java vulnerabilities efficiently.

Insights into Oracle’s Modifications to Java Licensing and Pricing

Since 2019, Oracle has implemented several alterations in Oracle JDK licensing and pricing. These revisions have chiefly aimed at requiring commercial users of Oracle’s Java to pay for using this previously free open-source development language.

Developments in 2019 and 2021

Starting from Oracle JDK 8 with the 2019 update, Oracle aimed to compel businesses utilizing Oracle Java for commercial purposes to acquire an Oracle Java SE subscription. In 2021, due to backlash, Oracle reversed its decision, allowing commercial production from Oracle JDK 17 onwards.

The 2021 adjustments solely applied to Long Term Support versions of Java for a minimum of one year post the release of the subsequent LTS version, a timeframe shorter than that offered by competitive OpenJDK distributors. Moreover, the new licensing conditions did not authorize redistribution for a fee.

The recent update in 2023

In 2023, Oracle declared that organizations using Oracle Java would need to purchase a license covering their entire workforce if even a single employee or server had deployed a licensable Java version.

As this pricing alteration was not dependent on the actual count of Java users but encompassed even contractors linked to an organization, it resulted in substantial cost hikes for companies opting to persist with Oracle Java.

The Impact of Oracle’s Java Licensing and Pricing Modifications

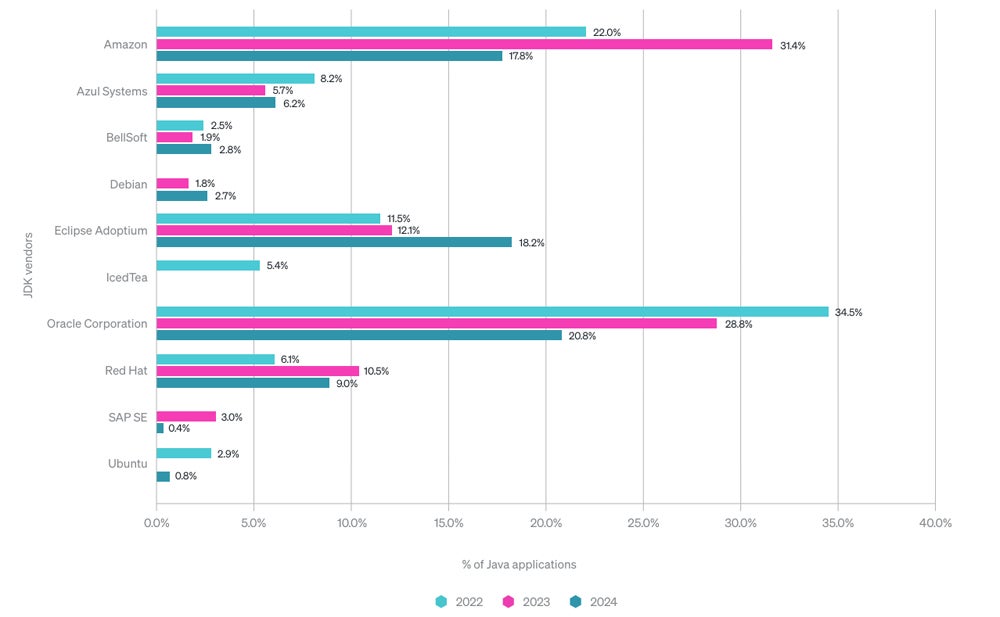

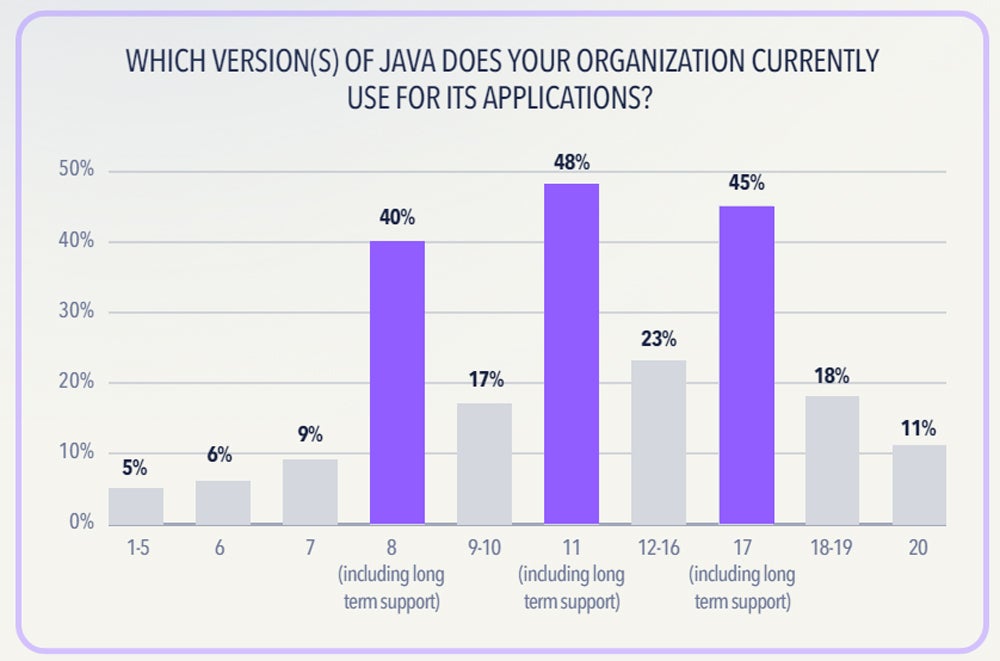

With Oracle targeting enterprises using Oracle JDK, many are contemplating or transitioning to alternatives. According to New Relic’s 2024 State of the Java Ecosystem report, Oracle’s Java market share plummeted from 75% in 2020 to 21% in 2023, marking a 29% decrease in one year.

SEE: Our comprehensive guide to navigating directories in Java

“There was a noticeable shift away from Oracle binaries following the stricter licensing of JDK 11 (before the return to a more open approach with Java 17), leading to a consistent year-over-year decline,” as quoted by New Relic.

Azul’s 2023 State of Java Survey and Report, surveying 2,000 Java-utilizing businesses, indicated a drop in Oracle’s market share from 75% in Java Development Kit distributions in 2020 to 42% employing at least one instance of Oracle Java in 2023.

The report from Azul showcased that Oracle’s latest 2023 licensing and pricing update instigated “widespread concern.” Approximately 82% of businesses voiced apprehensions regarding this change, with about 72% actively seeking alternatives to Oracle Java.

Filling the space for Java users was Amazon, with Coretto capturing 31% of the market in 2023, although this share decreased to 18% by 2024. Various other suppliers, including community-managed Eclipse Adoptium and Azul Systems, have seen a surge in interest too.

The Surge in Interest for Alternative JDK Providers in APAC Benefits Azul Systems

Azul’s APAC operations are reaping the rewards of the shift away from Oracle JDK. The company offers a reliable OracleJDK substitute, termed Azul Platform Core, along with a high-performance, consistent, and efficient premium offering named Azul Platform Prime.

Dean Vaughan, Azul’s Vice President APAC, revealed to TechRepublic that post Oracle’s 2023 licensing revision, the company experienced significant growth in Australia, Malaysia, India, Taiwan, and The Philippines. Additionally, they have recently onboarded Japanese global conglomerates.

Three Merits of Delving into Java Usage

Java’s broad integration within enterprises has amplified concerns over Oracle’s licensing adjustments. Nevertheless, organizations compelled to examine their Java utilization can also leverage advantages such as optimized cloud expenses, enhanced security, and enhanced competitiveness within their sector as well as in the talent acquisition domain for developers.

1. Optimizing Java Infrastructure Costs in the Cloud

Vaughan from Azul stated that APAC enterprises expanding in the cloud are witnessing substantial cost escalations through cloud providers like AWS or Azure, or regional players like Tencent or Alibaba. While some cloud services assist in workload rationalization to curtail costs, Vaughan highlighted the necessity of examining the entire stack.

Azure is observing an increase in demand from cloud-native enterprises located in regions such as ASEAN, India, and China. He highlighted that these nations have nurtured their own local tech sectors extensively and are more inclined towards innovative approaches in selecting OpenJDK providers or optimizing Java to significantly reduce cloud expenses.

2. Handling vulnerabilities in outdated Java releases

Emphasizing on security, compliance, and governance serves as a major motivator for prioritizing Java updates. Due to the potential risks associated with vulnerabilities in older Java versions and recent incidents like the Log4Shell vulnerability impacting 80% of Java users, organizations aim to uphold best practices by upgrading to more recent Java editions, as per Azure.

One of the features of Azul’s Intelligence Cloud offering, situated atop its Platform Core and Prime Java solutions, is the capability to pinpoint and address any identified vulnerabilities within Java versions. By determining which detected vulnerabilities have been deployed in production, an organization can ensure that DevOps teams allocate effort to the right areas.

3. Enhancing competitiveness with newer or premium Java editions

Several enterprises aspire to modernize by transitioning to more recent Java editions. This shift can offer benefits such as attracting youthful, skilled developers and empowering development teams with the latest Java innovations. “Java has evolved significantly over the last decade, thus for some businesses, investing in it may yield worthwhile outcomes,” mentioned Tene.

Azure’s premium Java version known as Java Prime has garnered interest in sectors like financial services in APAC. Tene highlighted that these firms are drawn towards an enhanced Java version that is swifter, more reliable, and capable of managing extensive workloads. This ensures that they can sustain competitiveness within their specific market segment.