Delving deeper into the second segment of our series, we will investigate the specific kinds of digital misdemeanors prevalent in 2023 and their repercussions on the sector and its users. Drawing insights from Chainanlysis’s 2024 Crypto Crime Report, we will scrutinize various patterns in digital misconduct.

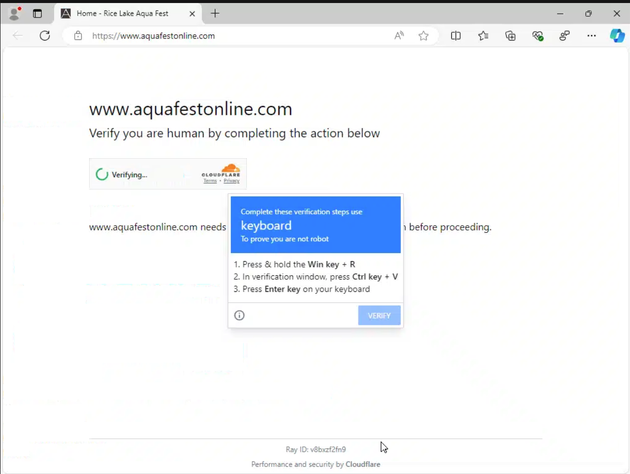

Extortion Software

In 2023, extortion software assaults intensified, focusing on prestigious establishments and vital infrastructure such as healthcare facilities, educational institutions, and governmental agencies. Significant attacks targeted the MOVEit file transfer software, impacting entities like the BBC and British Airways. These endeavors propelled the extortion gangs to exceed $1 billion in extorted cryptocurrency payments, reaching a momentous milestone.

The surge in ransom payments, the highest on record, signifies an escalating tendency from 2019 to 2023 despite a downturn in 2022. This statistic excludes the economic repercussions of diminished productivity and repair expenses, as evidenced by MGM Resorts’ encounter with ALPHV-BlackCat and Scattered Spider, resulting in over $100 million in losses despite no ransom fulfillment.

The landscape of extortion software continues to expand, rendering comprehensive monitoring a challenge. Officially reported figures are cautious and are anticipated to escalate as more venues of extortion software become known, as demonstrated by the upward adjustment of 2022 ransom payments from $457 million to a total 24.1% higher.

Illegal Money Transfer

In 2023, the unlawful money transfers via cryptocurrency notably declined, as illegitimate addresses sent $22.2 billion to various services, down from $31.5 billion in 2022. This 29.5% reduction in illegal financial activities is steeper than the 14.9% decline in overall digital transaction volume.

Illicit financial transactions in the cryptocurrency domain entail two principal categories of services: intermediary services and wallets (encompassing mixers, DeFi protocols, and personal wallets) for retaining or camouflaging funds, and fiat off-ramping services (e.g., centralized exchanges, P2P exchanges, betting services, and digital ATMs) for converting digital assets into fiat currency.

Centralized exchanges persisted as the primary endpoint for unlawful funds, sustaining a consistent rate over the previous five years. While the role of illegal services waned, the percentage of illicit funds flowing into DeFi protocols surged, potentially owing to DeFi’s overarching expansion despite its transparent nature, which makes it less conducive for concealing financial transactions.

In 2023, there was a marginal reduction in illicit service categories and an uptick in funds being directed towards betting services and bridge protocols, reflecting a transformation in illicit financial activity tactics.

Misappropriated Funds

Cryptocurrency breaches have posed a substantial peril, resulting in billions of dollars being siphoned from digital platforms. In 2022, $3.7 billion disappeared due to theft, marking the most significant year for digital larceny. However, in 2023, stolen funds plummeted by 54.3% to $1.7 billion despite assaults from 219 to 231.

The primary reason for the dip in stolen funds is the substantial reduction in DeFi breaches. In 2022, $3.1 billion was expropriated from DeFi protocols, which decreased to $1.1 billion in 2023, a 63.7% reduction. Although DeFi violations persisted, such as Euler Finance losing $197 million in March and Curve Finance losing $73.5 million in July, the collective value pilfered from DeFi platforms dwindled.

Despite the overall drop in stolen funds, malefactors are becoming increasingly sophisticated and varied in their strategies. Nevertheless, digital platforms are enhancing their security measures and response tactics. Timely interventions by platforms and law enforcement personnel can aid in reclaiming stolen funds and amassing data on the perpetrators. As these procedures continue to refine, the sum of funds filched from digital infringements is likely to decrease.

CSAM

CSAM (child sexual abuse material) transactions employing cryptocurrency are on the rise, despite being a minimally researched facet of digital misconduct. Authorities have dismantled platforms like Welcome to Video, underscoring the issue. While not all CSAM undertakings involve cryptocurrency, its usage is growing among buyers and sellers.

The Internet Watch Foundation indicates that virtual currency is widely favored in these transactions, inciting collaborations with law enforcement agencies and financial sectors to bolster investigations. This evaluation seeks to furnish an initial, impartial appraisal of the CSAM-cryptocurrency nexus.

Illegal Financial Backing

The utilization of cryptocurrency by terrorist factions is a source of concern due to its potential for fostering illicit undertakings. Despite its transparency, blockchain technology’s traceability diminishes its appeal for terrorist financing. Accurately estimating the volumes of such activities remains challenging in both fiat and digital transactions. Striking a balance between anti-terrorism campaigns and humanitarian assistance is intricate, as conflict-ridden regions present dual hazards. Validating properly and implementing a multifaceted strategy are imperative to preclude misinterpretations and ethical quandaries in combatting terrorism funding.

Deceptive Schemes

In 2023, deceptive schemes within the cryptocurrency realm persisted as a substantial subset of digital misconduct, generating at least $4.6 billion in revenue. This denotes a decline from 2022, but the figure is a conservative estimate founded on presently identified fraudulent addresses. Anticipated growth in identified scam addresses by Chainalysis may augment the reported statistics. For instance, the estimated revenue from scams in 2022 has been revised from $5.9 billion to $6.5 billion.

Scammers are enhancing their sophistication, employing stratagems like romantic frauds (or “pig butchering” scams) where they interact with victims directly through private channels like SMS. This renders identifying addresses linked to scams more challenging unless victims disclose their losses, potentially leading to an underrepresentation of scam-related activities, particularly given the recent proliferation of such ploys. Detecting these schemes proves to be more intricate compared to the grander, more publicized Ponzi schemes of yesteryears.

Underground Markets

In 2023, the subterranean market ecosystem displayed recovery signs but has not yet exceeded the revenue levels observed before the closure of Hydra Marketplace in 2022. Despite Hydra’s dominance and fiscal triumph, no other marketplace has emerged as an all-encompassing source for illicit goods and services. The censure and termination of Genesis Market last year stood out as prominent occurrences, with no significant censures or substantial market closures reported in 2023. Developments in the subterranean market sphere will be monitored through 2024, focusing on novel stratagems that markets and deceit shops might adopt to attract more clientele.

Essential Insights

- Chainalsyis’ findings accentuate the persistent menace of scams in the digital currency realm. Below are several crucial insights from the report:

- Anticipated growth in revenue from crypto scams in 2024 as scammers innovate and employ fresh tactics to target victims.

- Romantic frauds have emerged as a prevalent issue as scammers adopt private channels like text messaging to interact with their victims.

- Despite indications of recovery, darknet markets have yet to achieve pre-Hydra revenue levels. Notably, no alternative market has emerged as a comprehensive source for unlawful goods and services.

- Individuals must exercise caution when engaging in digital currency transactions and always verify the authenticity of any investment before proceeding.

- Governments and agencies are intensifying their endeavors to combat cryptocurrency scams, yet it remains incumbent upon individuals to shield themselves from falling prey.

Closing Remarks

The emergent realm of cryptocurrency offers myriad avenues for financial advancement, but it also entices fraudsters seeking to exploit vulnerable individuals. As the sector continues to expand and evolve, individuals must educate themselves on potential risks and remain vigilant to safeguard their investments.

This discourse draws from Chainalysis‘s report, `The 2024 Crypto Crime Report`, and elucidates the pivotal assertions by Trend Micro from a cybercrime vantage point. For further insights, kindly reference the comprehensive report.